Capital Investment Templates

Invested Capital and Capital Investment Knowledge System

Welcome to the Invested Capital and Capital Investment Knowledge System

. Here you will find comprehensive information and resources related to invested capital and capital investment.Whether you are an individual investor, a business owner, or a financial professional, understanding the concepts of invested capital and capital investment is crucial for making informed financial decisions. Our knowledge system provides in-depth insights, tips, and guidelines on how to effectively manage and maximize your capital investments.

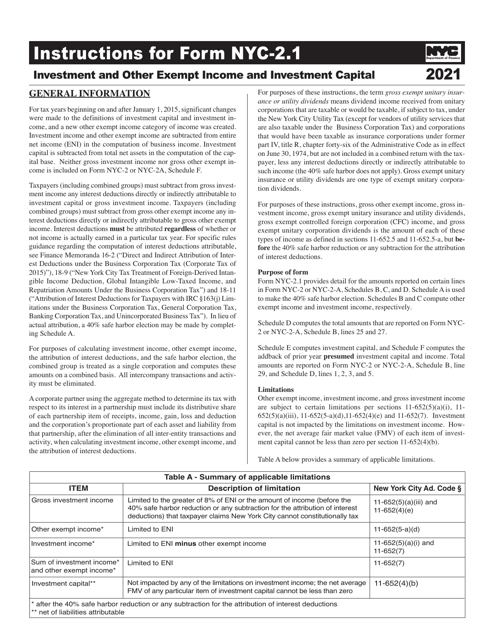

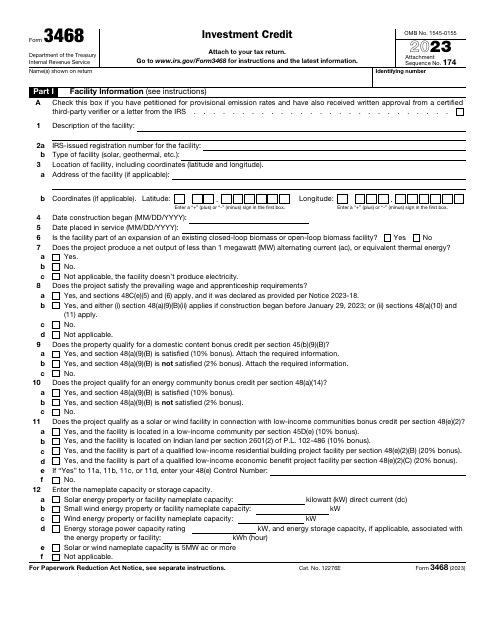

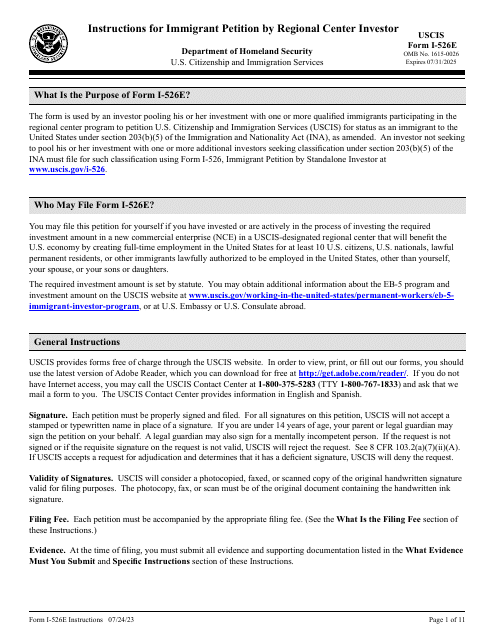

Explore a wide range of topics including tax returns for invested capital, investment income, exemptions, and more. We offer a variety of resources, such as instructions for various tax forms, like Form ICT-4-X, 493 Amended Electricity Distribution and Invested Capital Tax Return - Illinois, Form NYC-2.1 Investment and Other Exempt Income and Investment Capital - New York City, Form CT-3.1 Investment and Other Exempt Income and Investment Capital - New York, and many more.

Stay up to date with the latest regulations, and learn strategies for optimizing your capital investment portfolio. Our user-friendly interface makes navigating through the knowledge system a breeze, allowing you to easily access the information you need.

Unlock the potential of your invested capital with our Invested Capital and Capital Investment Knowledge System

. Gain valuable insights, stay informed, and make confident financial decisions. Begin exploring today!Documents:

19

This form is used for applying for a capital investment tax exemption on multiple dwellings in the City of Niagara Falls, New York.

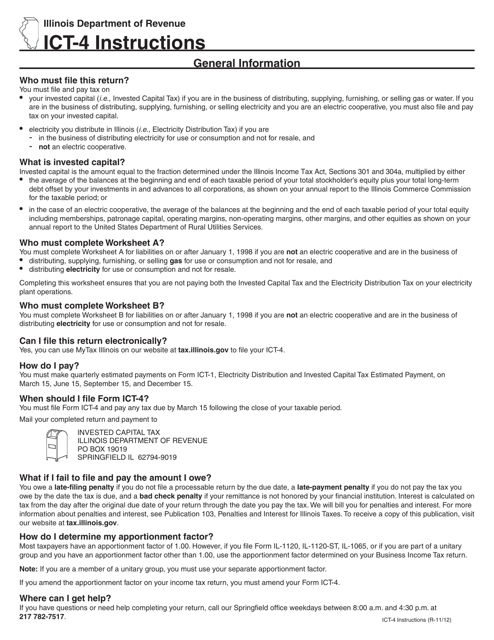

Instructions for Form ICT-4, 491 Electricity Distribution and Invested Capital Tax Return - Illinois

This document is used for filing the Electricity Distribution and Invested Capital Tax Return in Illinois. It provides instructions on how to complete Form ICT-4, 491.

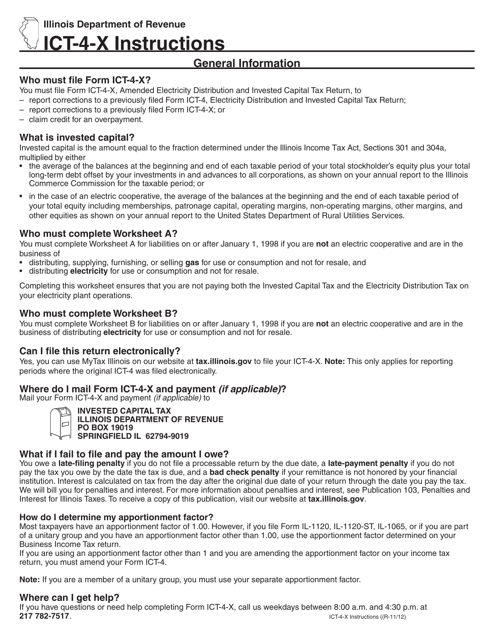

This Form is used for filing an amended electricity distribution and invested capital tax return in the state of Illinois. It provides instructions on how to make corrections or changes to the original tax return submission.

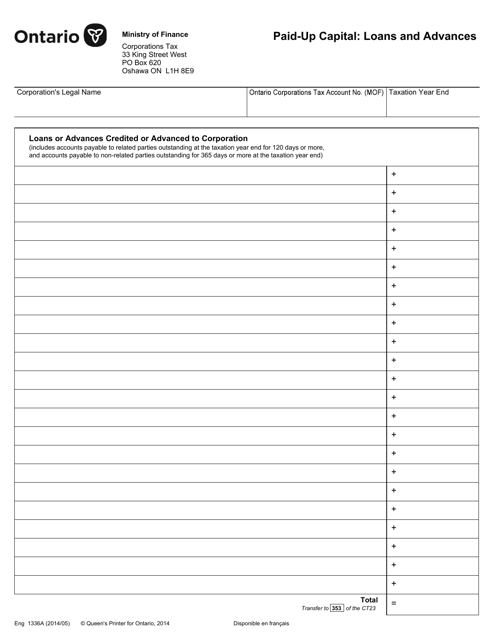

This form is used for declaring the paid-up capital, loans, and advances in Ontario, Canada.

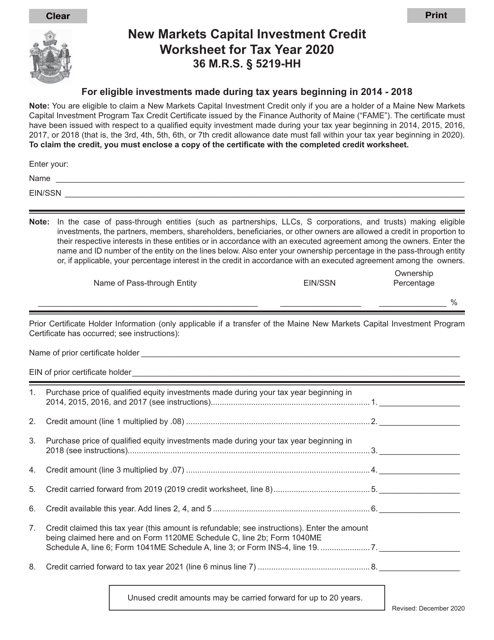

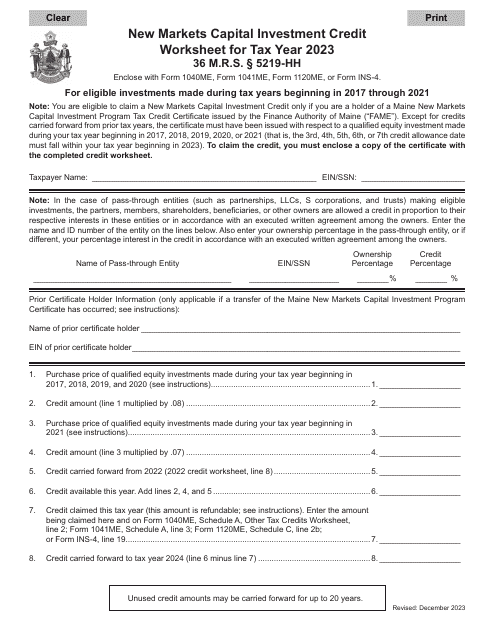

This document is a worksheet used in Maine for calculating tax credits related to capital investments in new markets.

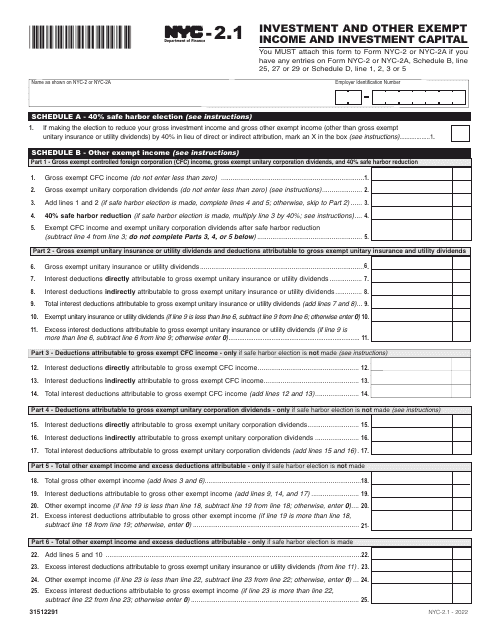

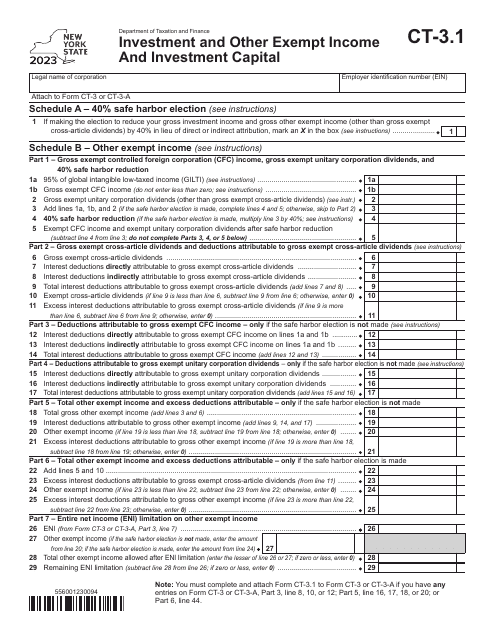

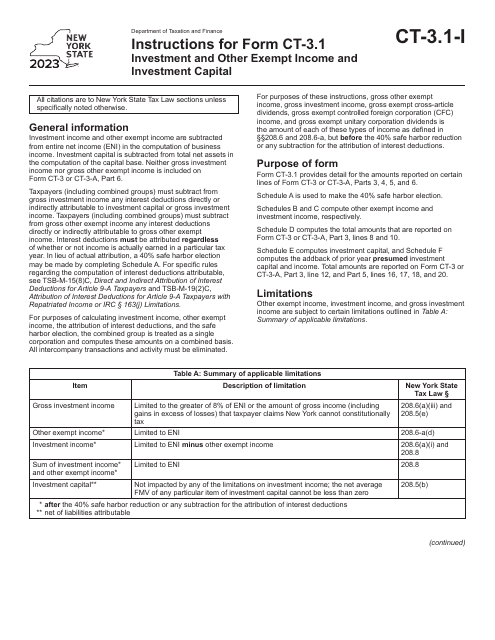

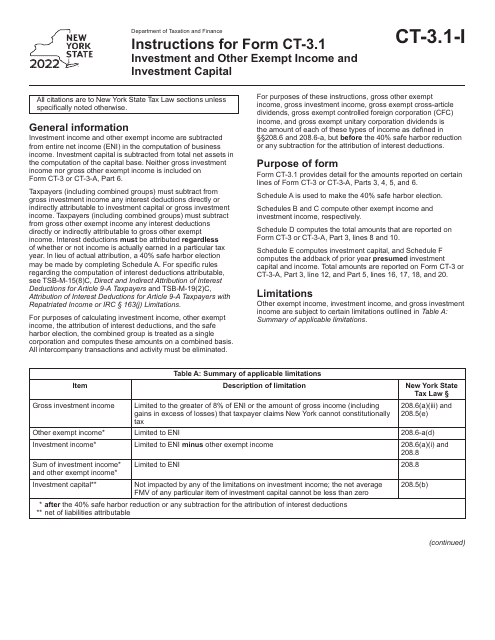

This form is used for reporting investment income and investment capital that are exempt from tax in the state of New York.

![Form RP-421-J [NIAGARA FALLS] Application for Capital Investment in Multiple Dwellings Real Property Tax Exemption; Certain Cities - City of Niagara Falls, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349861/form-rp-421-j-niagara-falls-application-for-capital-investment-in-multiple-dwellings-real-property-tax-exemption-certain-cities-city-of-niagara-falls-new-york_big.png)