Gross Receipts Templates

Welcome to our webpage dedicated to gross receipts, also known as a collection of documents related to the financial records of various businesses. Whether you are a corporation or an individual, understanding and reporting your gross receipts is an essential aspect of financial management.

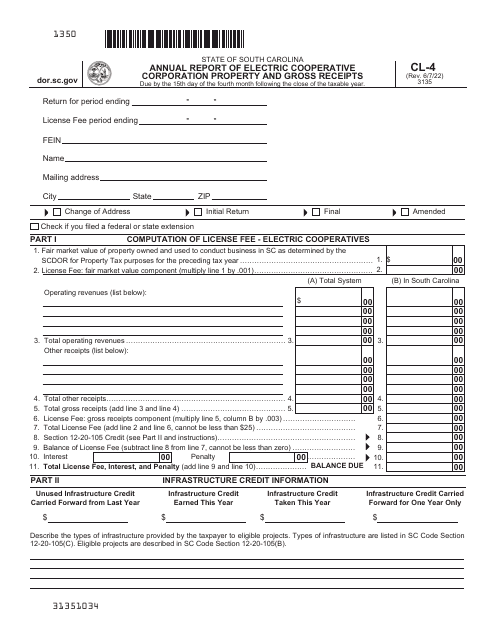

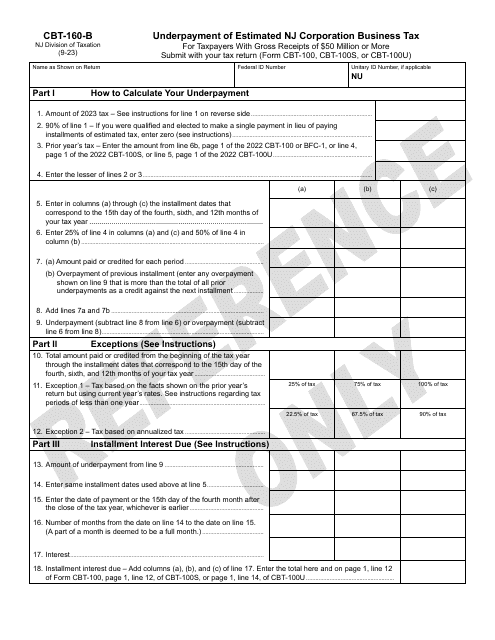

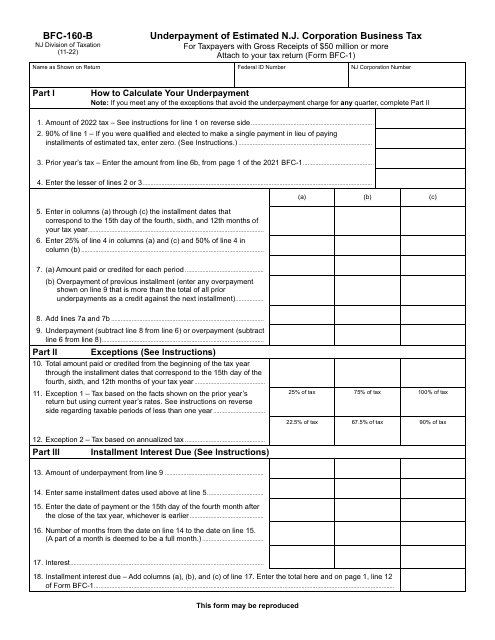

Here, you will find a comprehensive collection of documents that provide guidance on how to report your gross receipts accurately and in compliance with the relevant regulations. These documents, such as the Form CL-4 Annual Report of Electric CooperativeCorporation Property and Gross Receipts in South Carolina, or the Form CBT-160-B Underpayment of Estimated N.j. Corporation Business Tax for Taxpayers With Gross Receipts of $50 Million or More in New Jersey, serve as essential tools for businesses and organizations to fulfill their financial obligations.

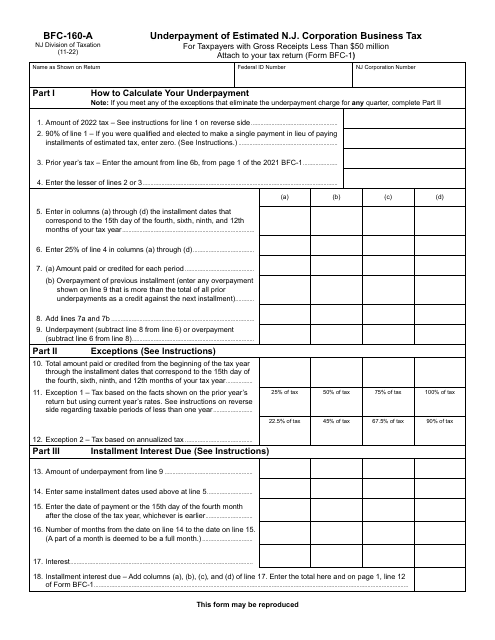

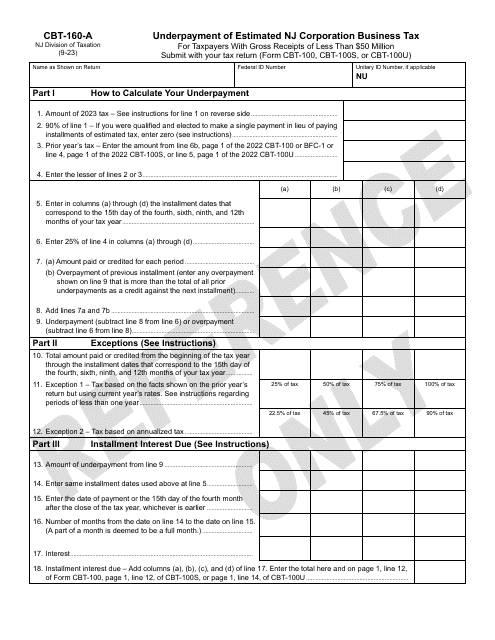

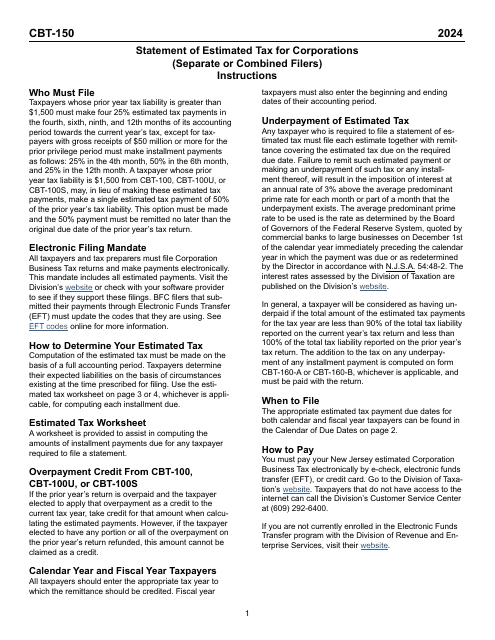

Our vast selection of documents caters to businesses of all sizes, ensuring that everyone can access the necessary resources to calculate and report their gross receipts effectively. By offering resources like the Form CBT-160-A Underpayment of Estimated Nj Corporation Business Tax for Taxpayers With Gross Receipts of Less Than $50 Million in New Jersey, we provide individuals and smaller businesses with the support they need for accurate financial record-keeping.

Navigating the complex world of gross receipts is made simpler with our user-friendly interface, allowing you to find the right documents quickly and conveniently. Whether you are looking for resources to comply with tax requirements or seeking guidance for financial planning, our collection of gross receipts documents has got you covered.

We understand that staying updated with the latest regulations and best practices is crucial for every business or organization. Therefore, we regularly update our documents to reflect any changes in the legal and financial landscape. By providing the Form CBT-160-B Underpayment of Estimated Nj Corporation Business Tax for Taxpayers With Gross Receipts of $50 Million or More, we ensure that our users have access to the most recent and relevant information.

In conclusion, our webpage dedicated to gross receipts offers a diverse range of documents designed to assist businesses and individuals in accurately reporting their financial records. Whether you are complying with tax regulations or planning your financial future, our collection is the go-to resource for all your gross receipts needs. So, explore our documents today and simplify your financial management journey!

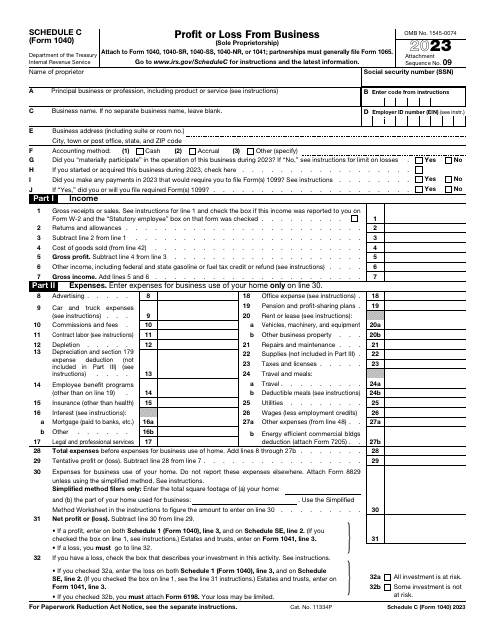

Documents:

44

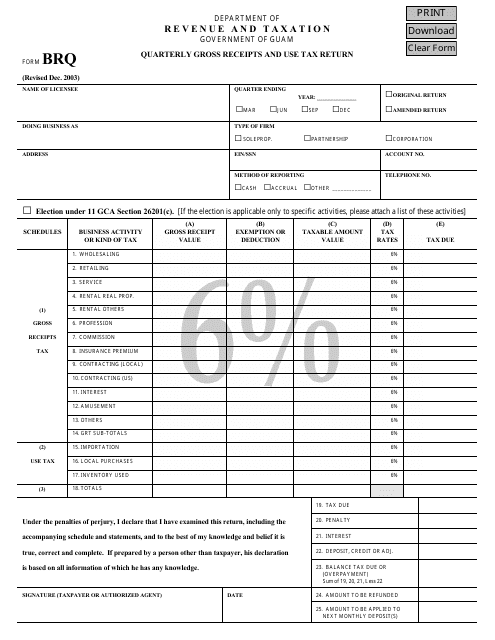

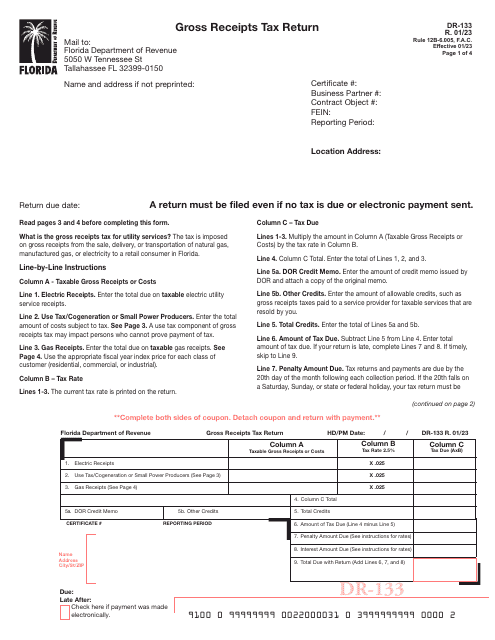

This form is used for reporting quarterly gross receipts and use tax in Guam.

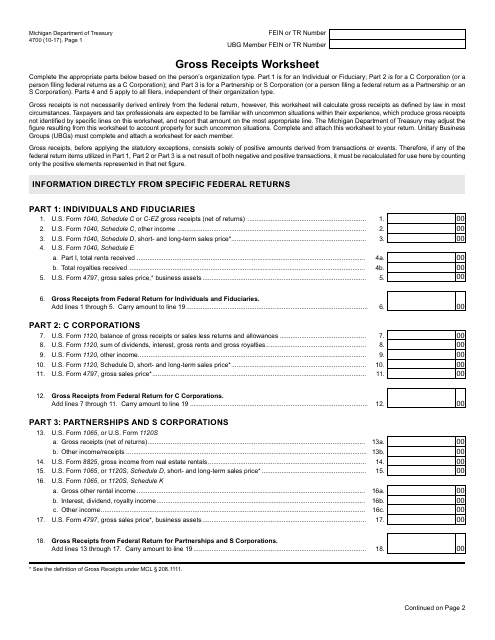

This form is used for calculating gross receipts in the state of Michigan. It helps businesses determine their total income for tax purposes.

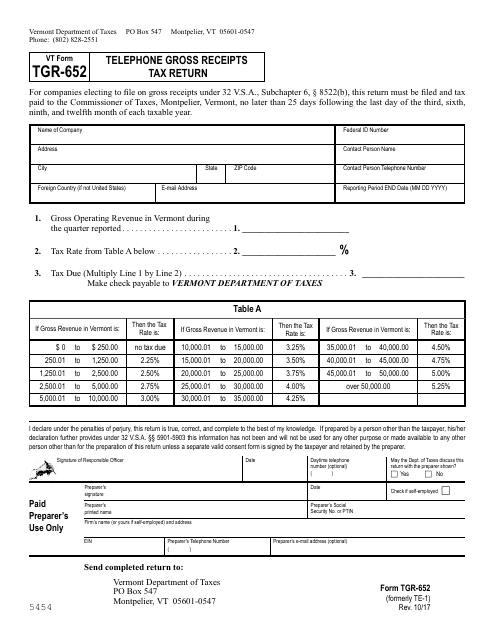

This Form is used for reporting telephone gross receipts for tax purposes in the state of Vermont.

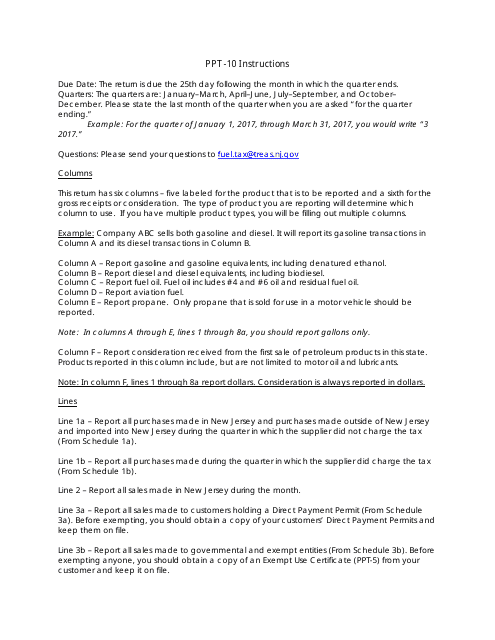

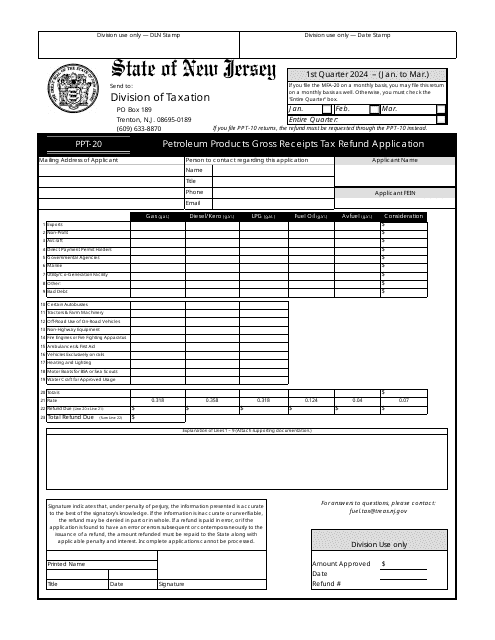

This Form is used for filing the Petroleum Products Gross Receipts Tax Return in the state of New Jersey. It provides instructions on how to accurately report and calculate the tax owed on petroleum products.

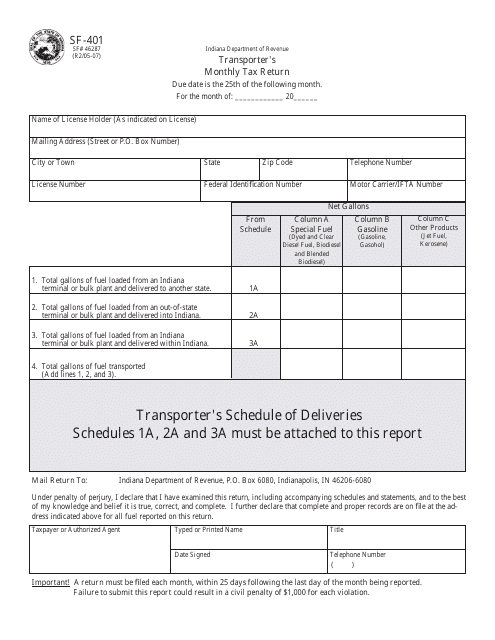

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

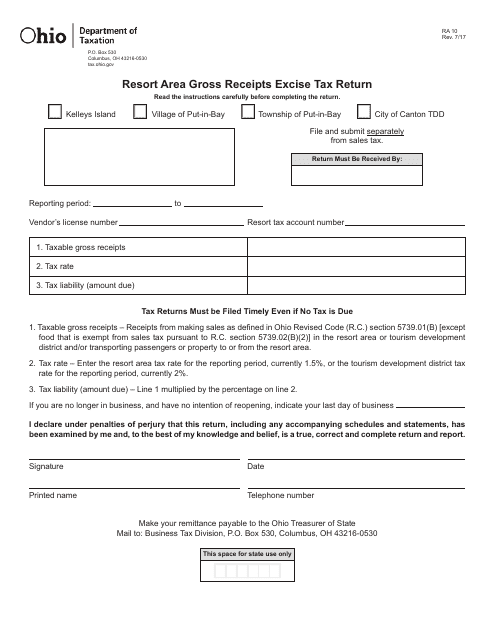

This form is used for reporting and paying the Resort Area Gross Receipts Excise Tax in Ohio.

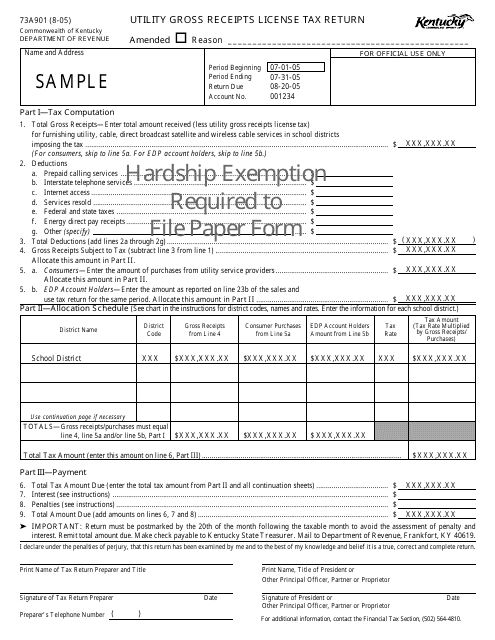

This form is used for filing the Utility Gross Receipts License Tax Return in Kentucky.

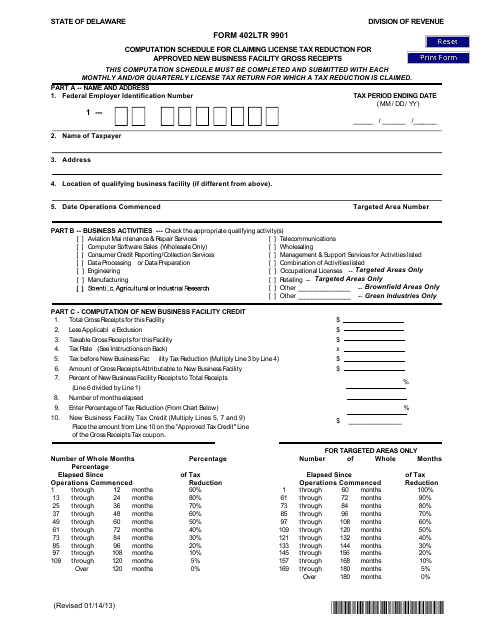

This form is used for claiming a license tax reduction for approved new business facilities in Delaware based on their gross receipts.

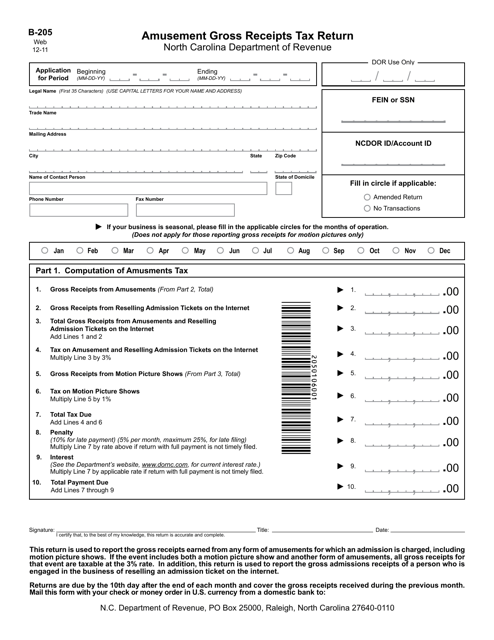

This document is used for reporting and paying the amusement gross receipts tax in North Carolina. It is a form that businesses engaged in amusement activities must fill out to calculate and remit the tax owed based on their gross receipts.

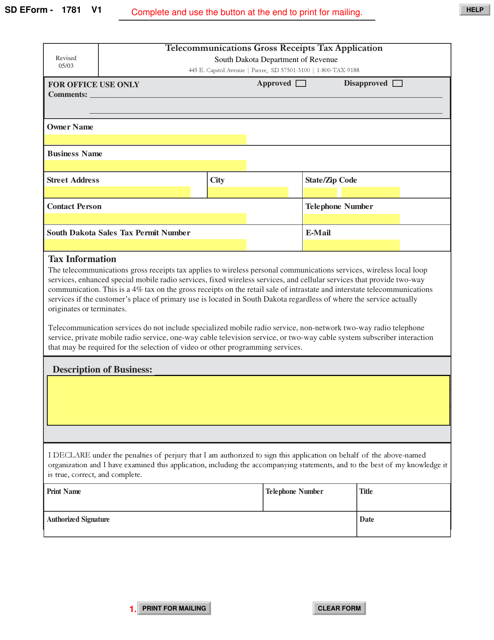

This Form is used for applying for the Telecommunications Gross Receipts Tax in South Dakota. It is a tax application form specific to the telecommunications industry in the state.

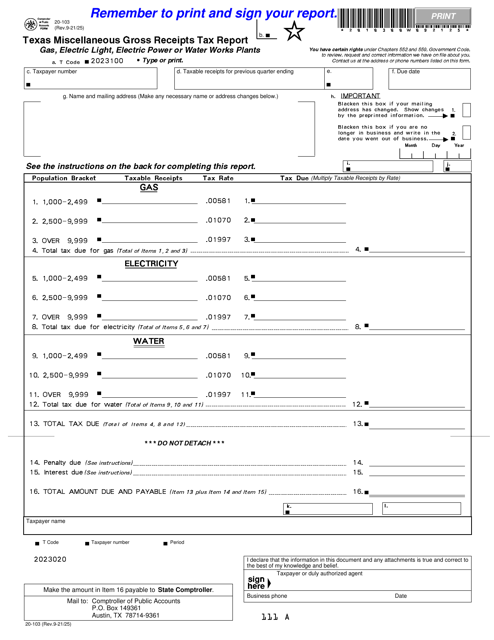

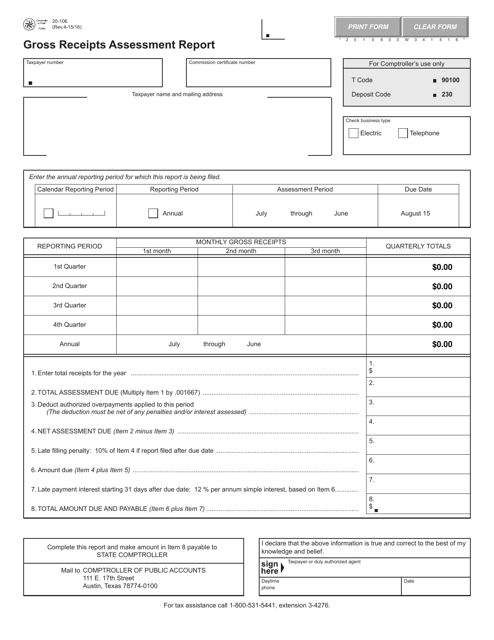

This form is used for reporting and assessing gross receipts in the state of Texas. It helps businesses comply with tax regulations by providing information on their income from sales or services.

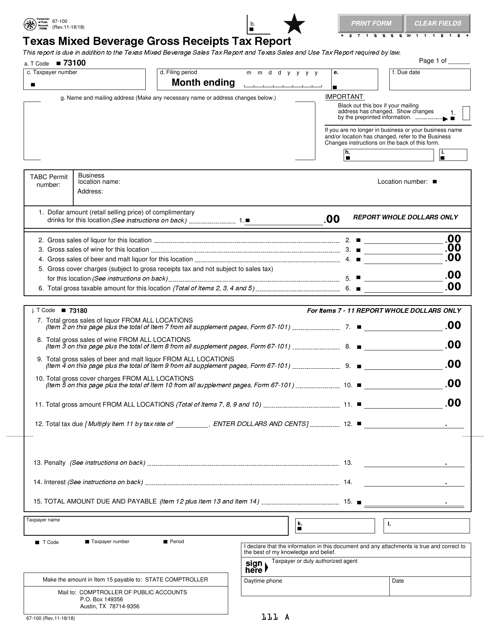

This form is used for reporting the gross receipts tax on mixed beverages in the state of Texas. It is required for businesses that sell mixed drinks.

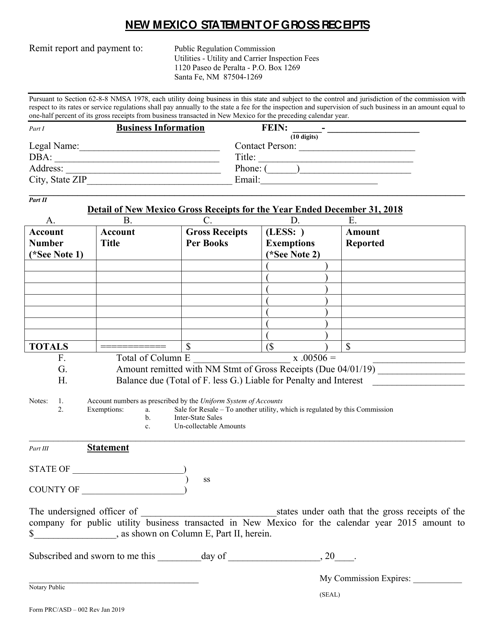

This form is used for reporting gross receipts in the state of New Mexico.

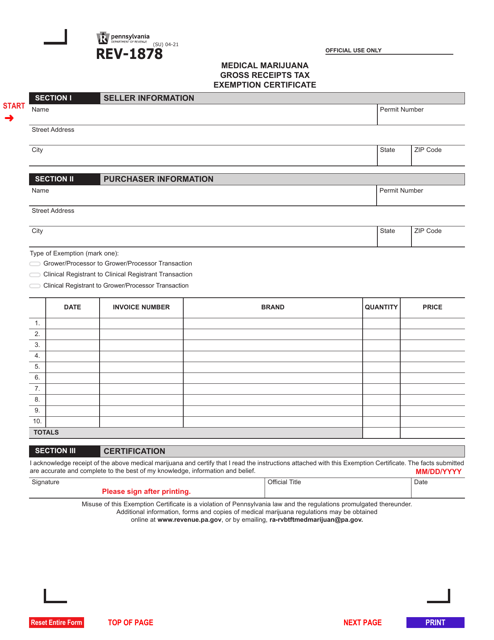

This form is used for claiming a tax exemption on gross receipts from medical marijuana in Pennsylvania.

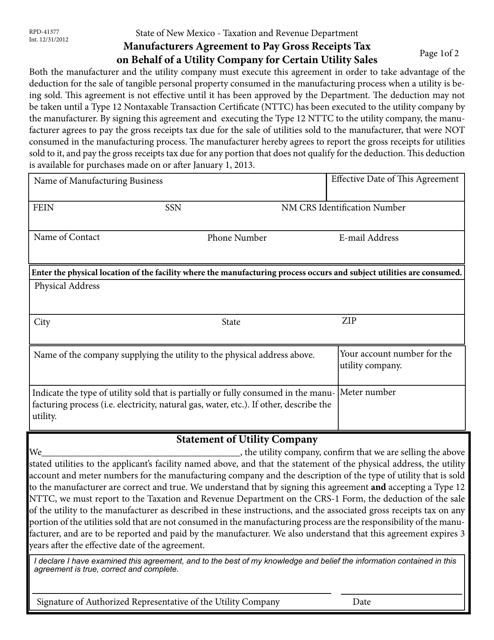

This document is used for manufacturers in New Mexico to agree to pay the gross receipts tax on behalf of a utility company for certain utility sales.

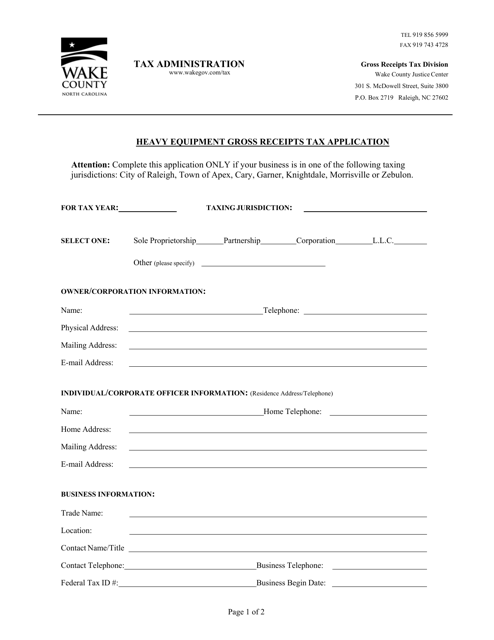

This Form is used for applying for the Heavy Equipment Gross Receipts Tax in Wake County, North Carolina.

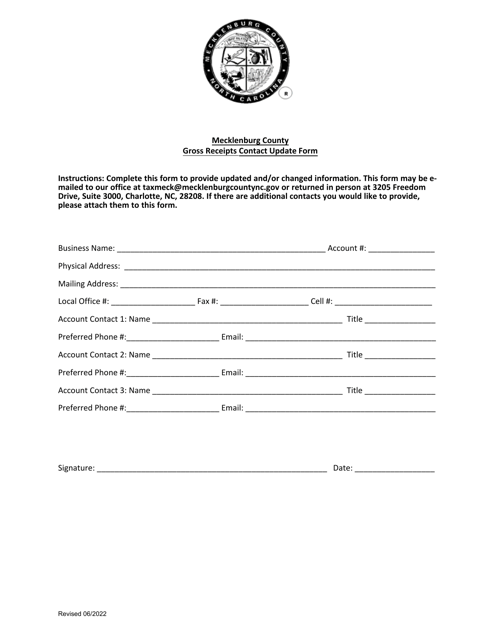

This Form is used for updating contact information related to gross receipts in Mecklenburg County, North Carolina.

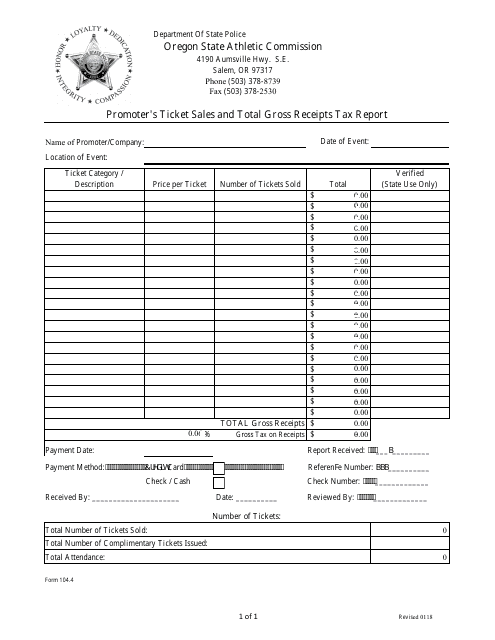

This document is used for reporting the promoter's ticket sales and total gross receipts tax in the state of Oregon.