Tax Rules Templates

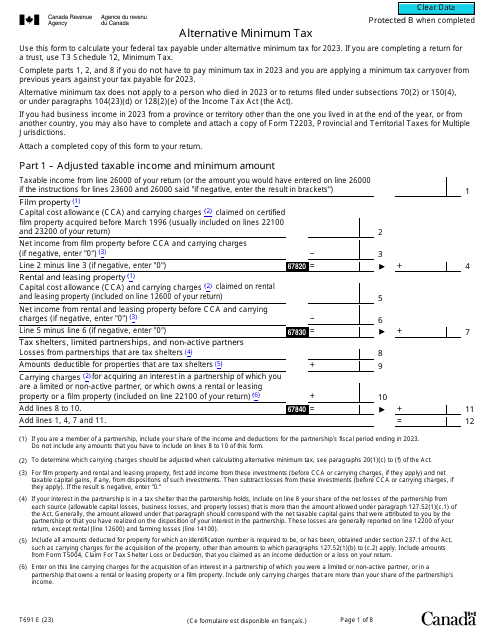

Are you looking for guidance on tax rules? From understanding the alternative minimum tax for estates and trusts to learning about tax credits for education and dependents, our extensive collection of tax rule documents can provide you with the knowledge you need.

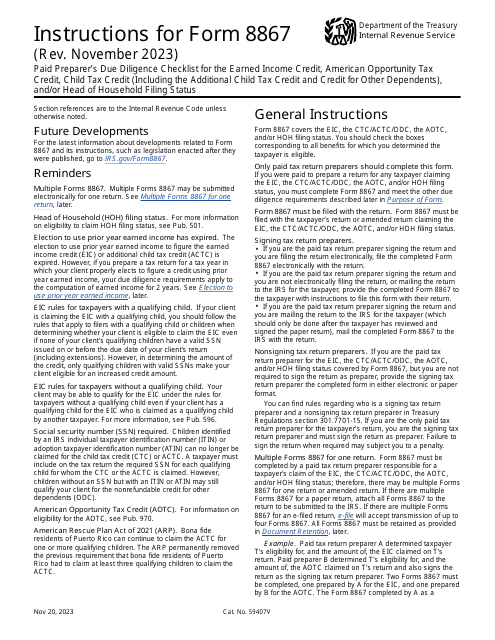

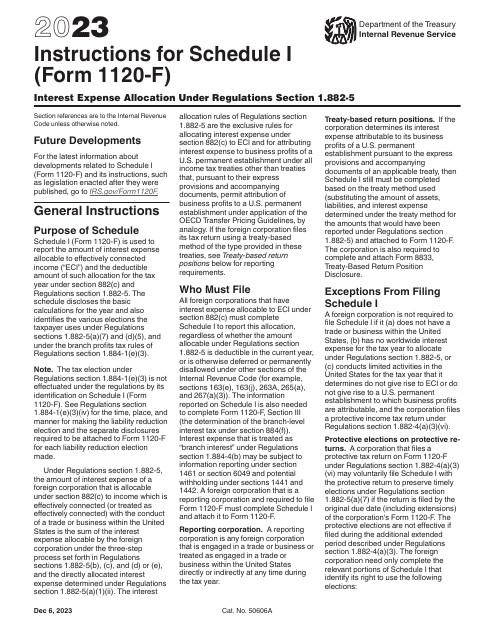

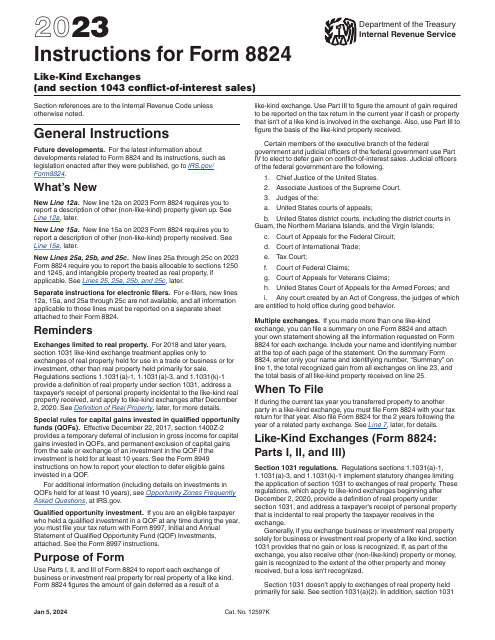

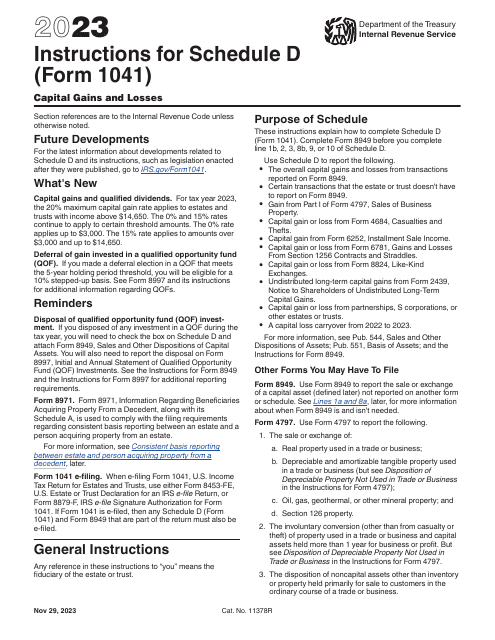

Whether you're a paid preparer in need of a due diligence checklist or an individual seeking guidance on like-kind exchanges, our tax rule documents cover a wide range of topics.

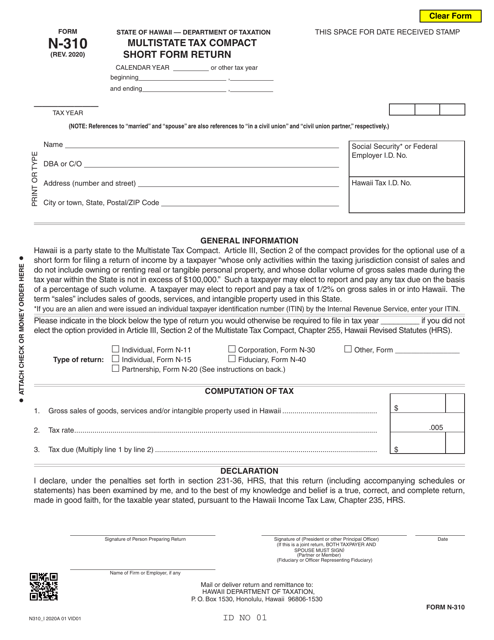

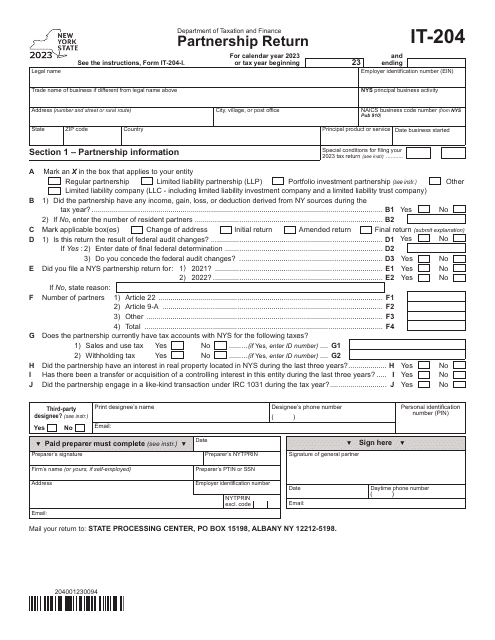

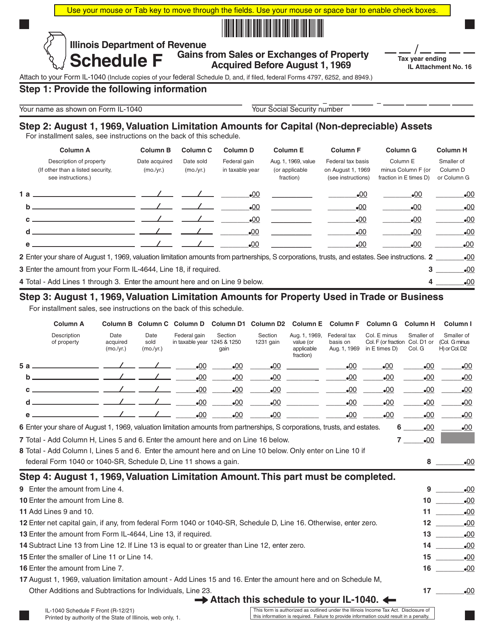

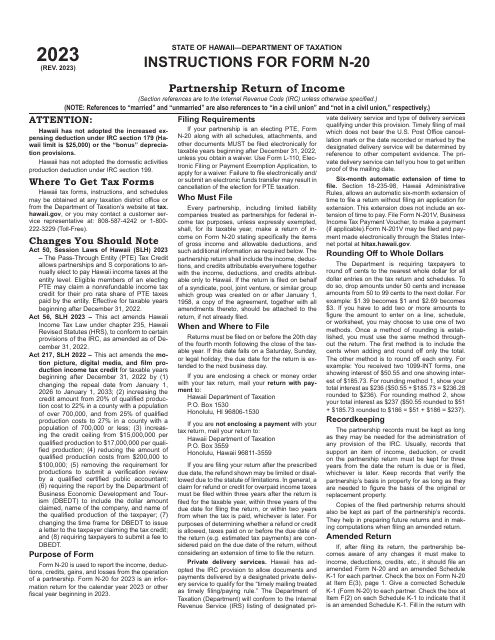

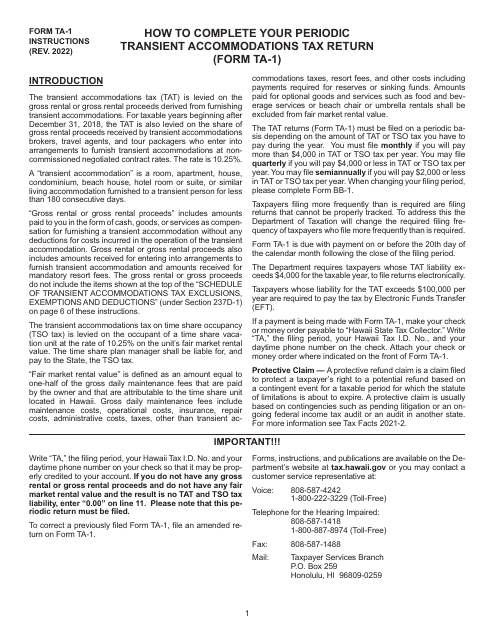

We even have specific instructions forstate tax returns, such as the Partnership Return of Income for Hawaii or the Transient Accommodations Tax Return.Our tax rule documents, also known as tax guides or IRS instructions, are designed to help you navigate the complexities of the tax system.

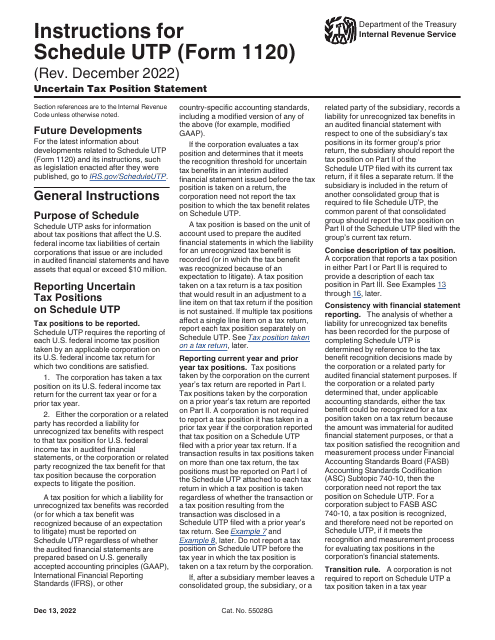

With clear explanations and step-by-step instructions, you can confidently prepare your taxes and ensure compliance with the latest regulations.Whether you're an individual taxpayer, a business owner, or a tax professional, our tax rule documents are a valuable resource for understanding and applying the tax rules that govern your financial obligations.

Explore our collection today and gain the knowledge you need to make informed decisions and maximize your tax benefits..

Documents:

38

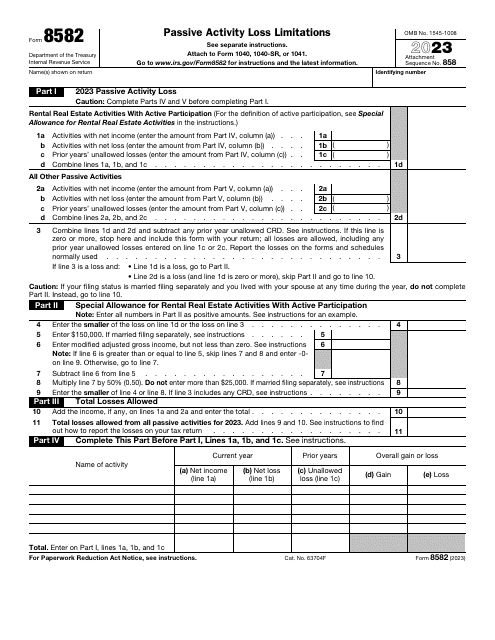

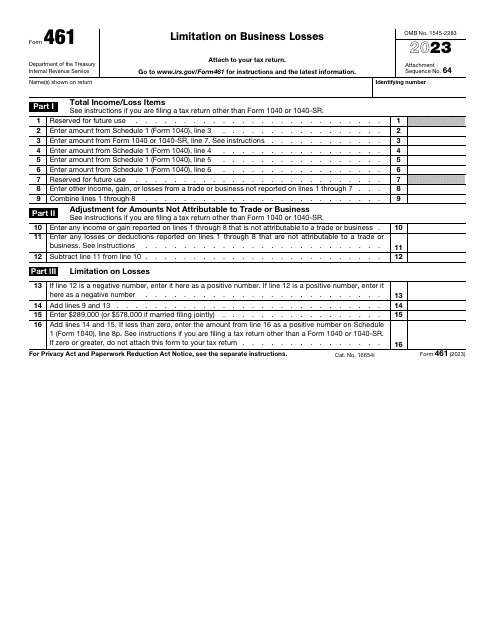

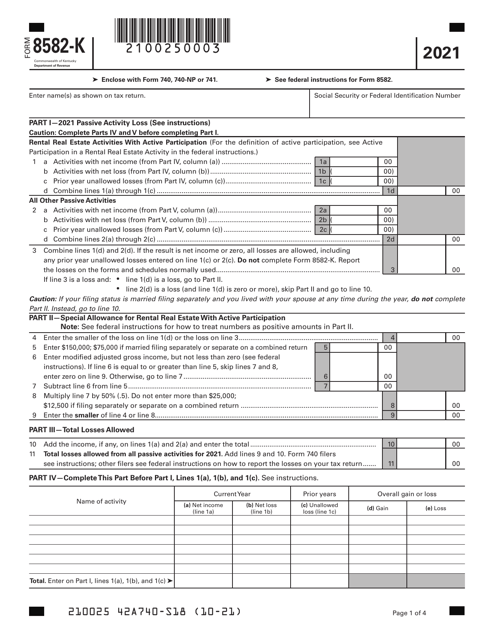

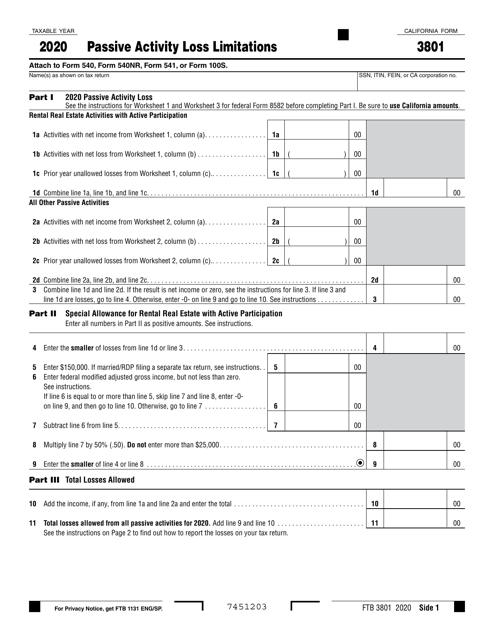

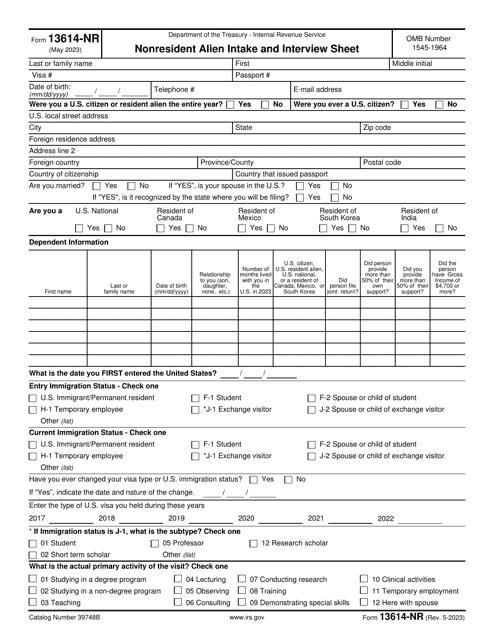

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

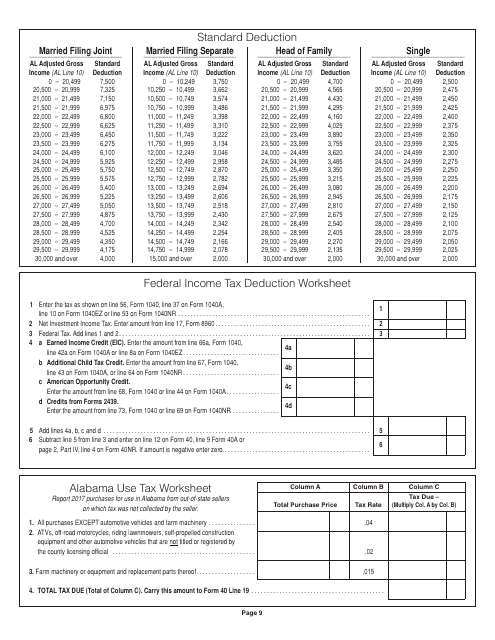

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

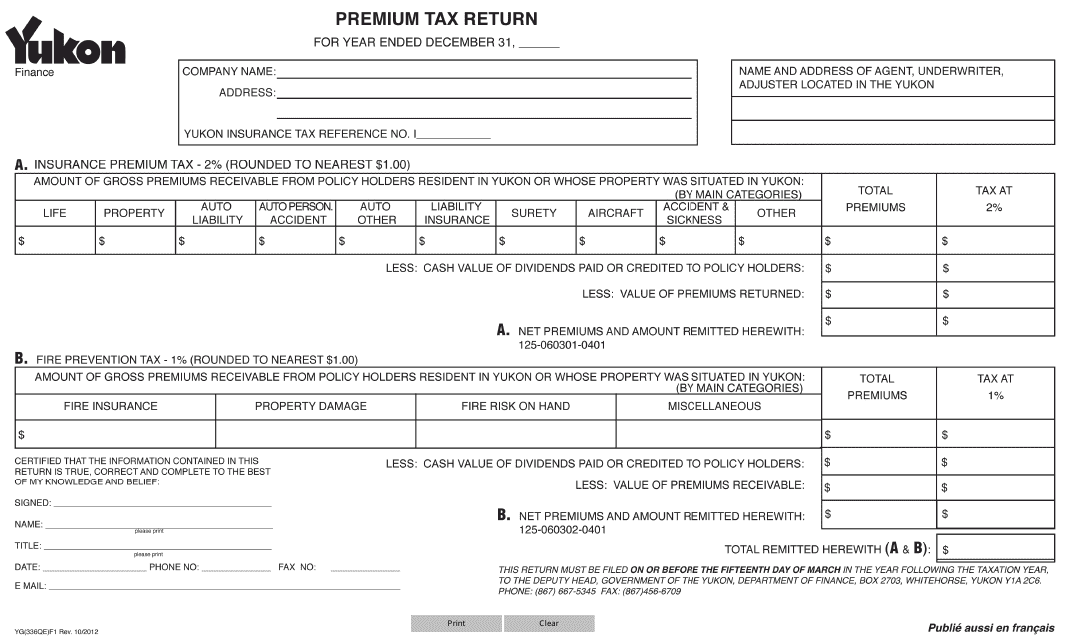

This form is used for filing premium tax returns in Yukon, Canada.

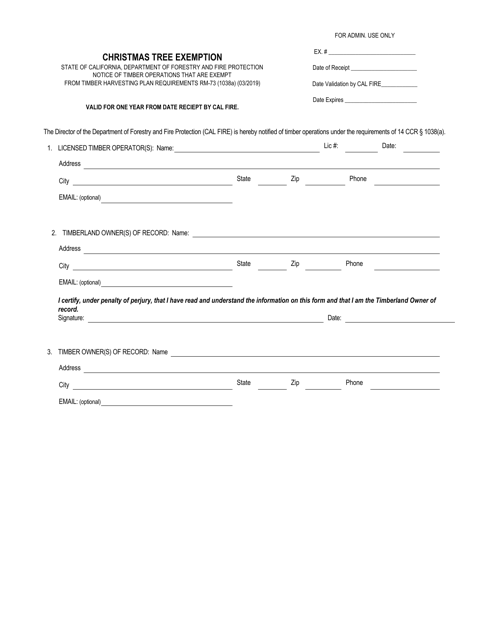

This form is used for requesting an exemption to cut down a Christmas tree in California.

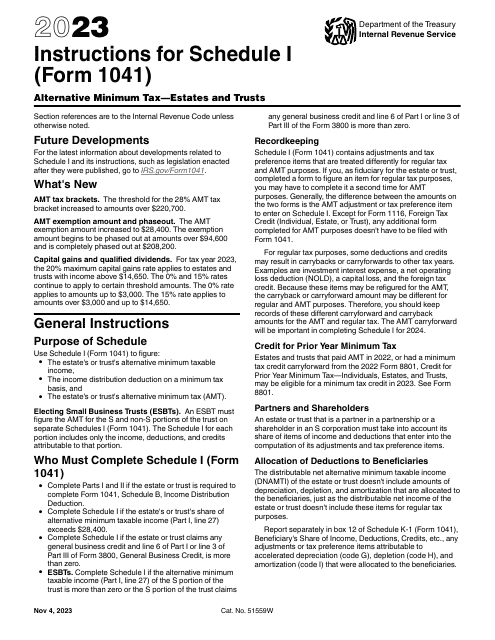

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

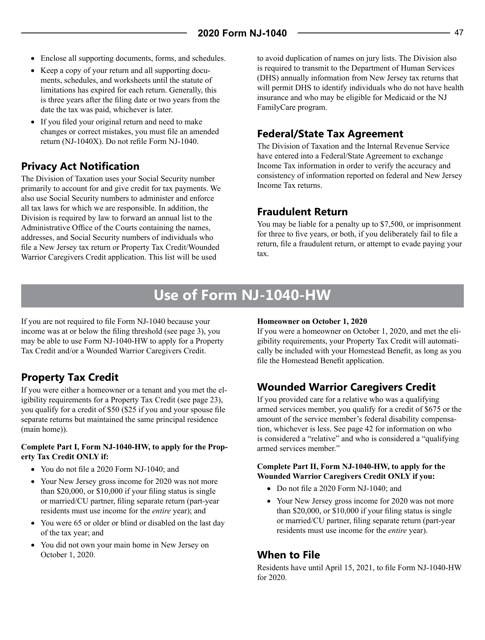

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

This form is used for reporting passive activity loss limitations in California.