Agriculture Tax Credit Templates

Are you a farmer looking for financial support for your agricultural activities? Look no further! Introducing the Agriculture Tax Credit, also known as Agricultural Tax Credits or Agricultural Tax Credit.

This group of documents is designed to provide valuable information and assistance to farmers like you who are eligible for tax credits related to agricultural activities. Some alternate names for this collection include Agriculture Tax Credits or even Agricultural Tax Credit, highlighting the financial benefits available to farmers.

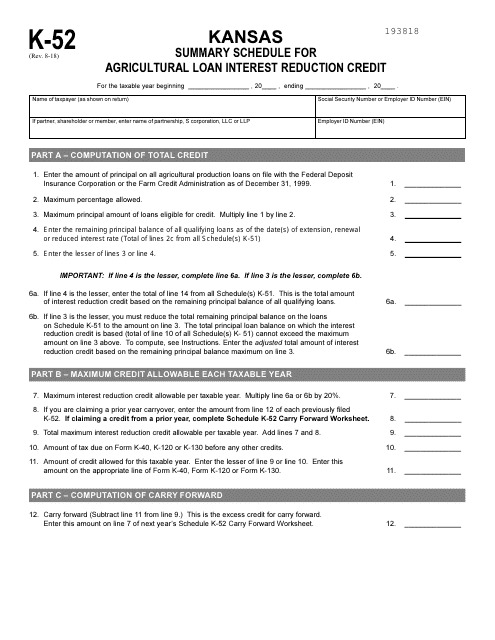

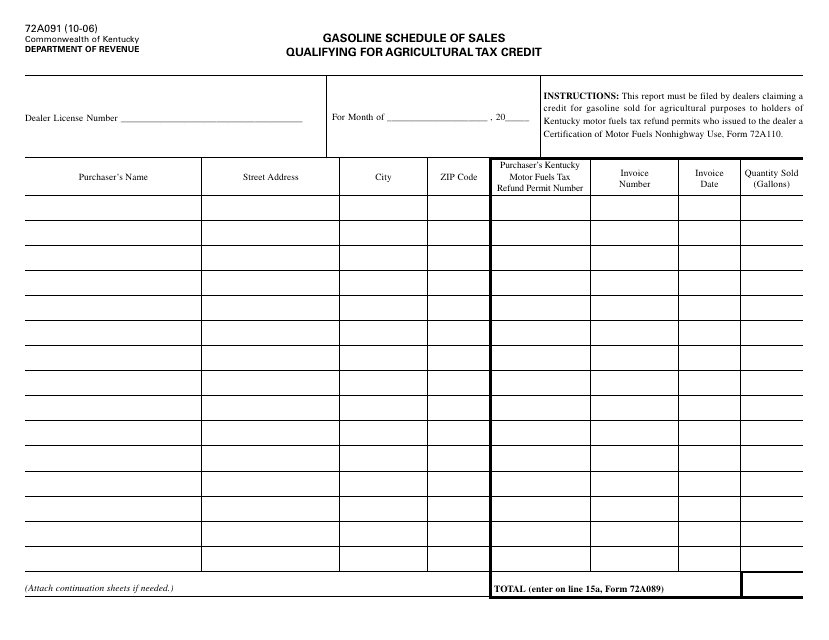

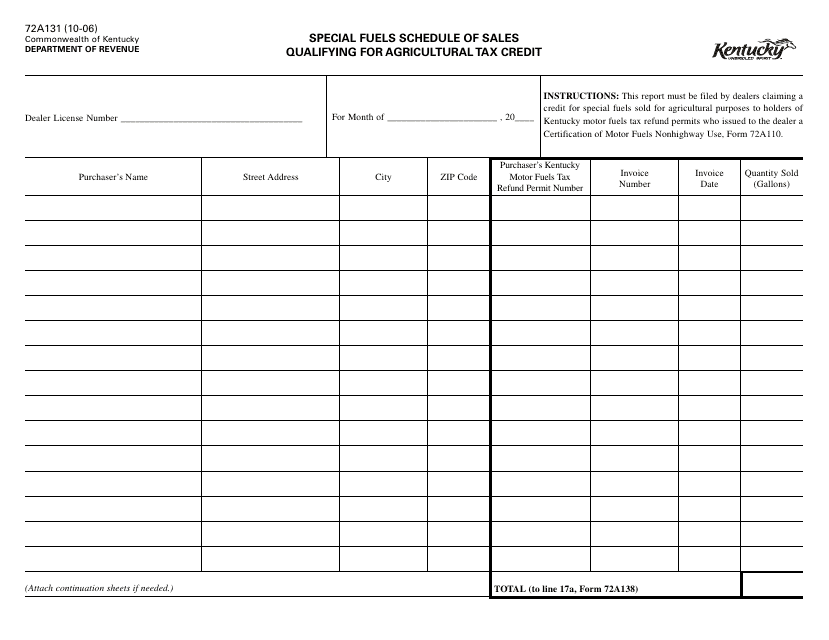

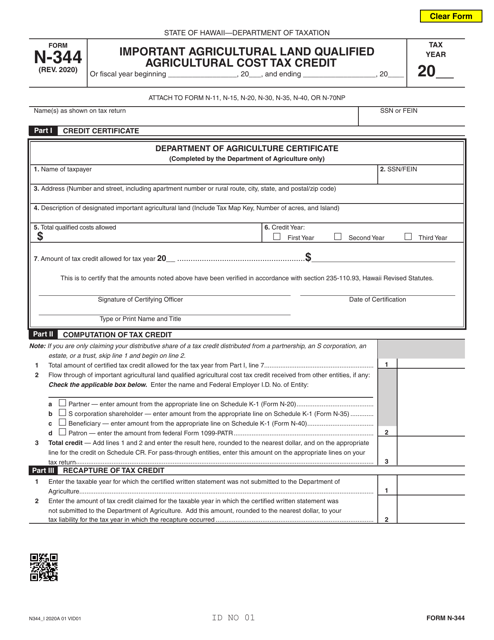

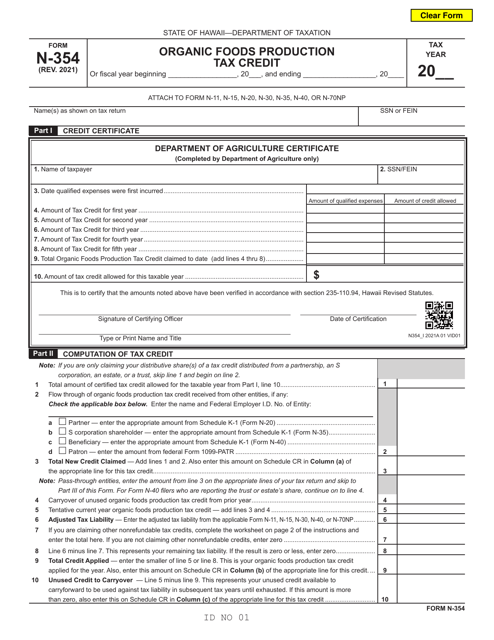

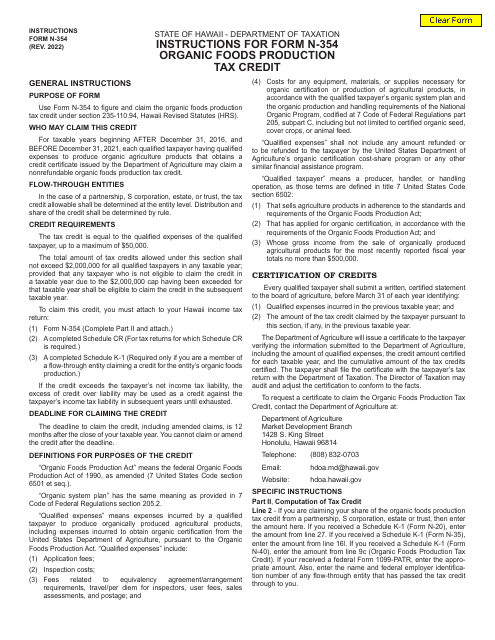

From specific forms such as Form 72A091 Gasoline Schedule of Sales Qualifying for Agricultural Tax Credit in Kentucky, to forms like Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit and Form N-354 Organic FoodsProduction Tax Credit in Hawaii, this comprehensive collection covers various aspects of tax credits available to farmers in different states.

If you have questions about the eligibility criteria and how to claim these tax credits, you can find the answers in the Instructions for Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit - Hawaii or the Instructions for Form I-025AI Schedule FC-A Farmland Preservation Credit - Wisconsin.

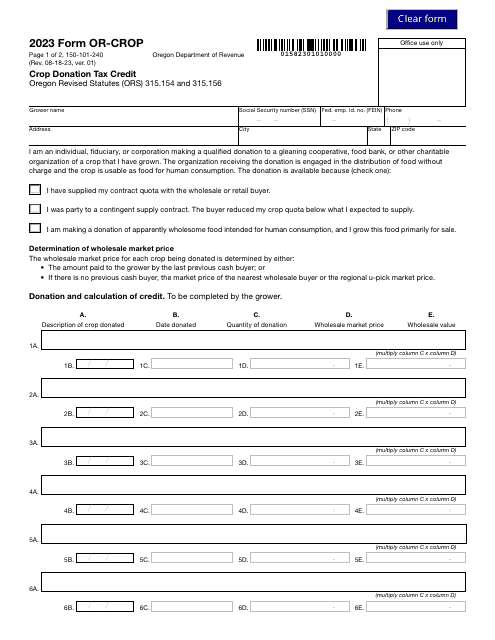

So, whether you are interested in tax credits for organic food production, important agricultural land, gasoline sales, or farmland preservation, this collection of documents on Agriculture Tax Credit has got you covered.

Take advantage of the financial assistance available to you as a farmer and explore the possibilities with Agriculture Tax Credits today!

Documents:

11

This type of document is used for providing a summary of the agricultural loan interest reduction credit in the state of Kansas. It is used by individuals or businesses who are claiming this credit on their tax return.

This form is used for reporting sales of gasoline that qualify for the agricultural tax credit in Kentucky.

This form is used for reporting sales of special fuels that qualify for the agricultural tax credit in Kentucky. It is specifically for agricultural businesses to claim tax credits on fuel purchased for qualifying agricultural activities.

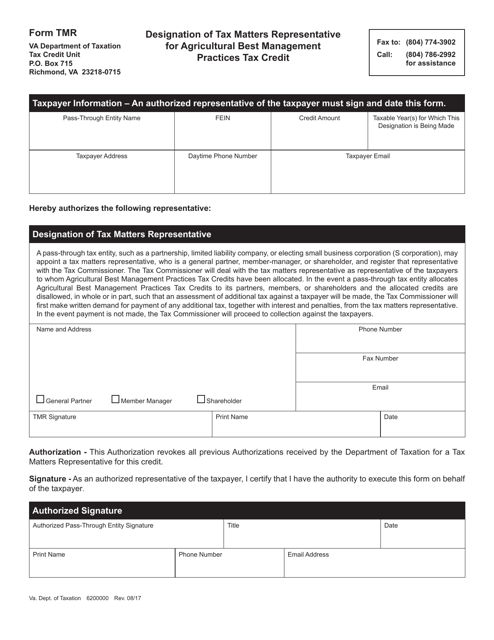

This form is used for designating a Tax Matters Representative for the Agricultural Best Management Practices Tax Credit in Virginia.

This Form is used for claiming the Farmland Preservation Credit in Wisconsin. It provides instructions on how to complete and file Form IC-025AI Schedule FC-A.