Earned Income Tax Credit Templates

The Earned Income Tax Credit (EITC), also known as the Earned Income Credit (EIC), is a tax benefit program designed to assist low to moderate-income individuals and families. This program aims to provide financial support by reducing the amount of federal incometax owed or even providing a refund.

If you are eligible for the Earned Income Tax Credit, you may be able to receive a significant amount of money back on your tax return. The EITC is particularly beneficial for working individuals or families with children.

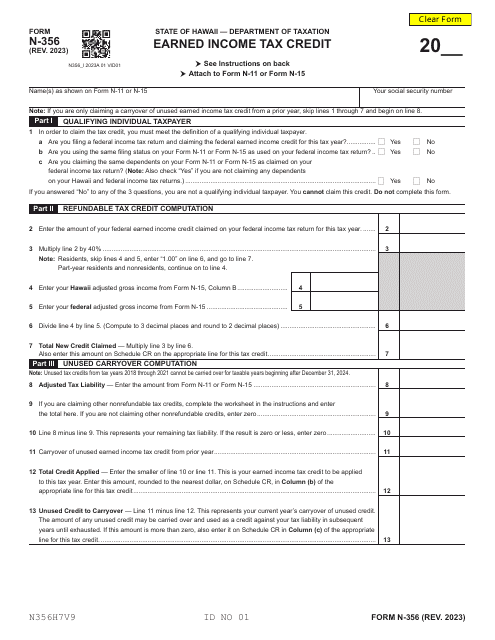

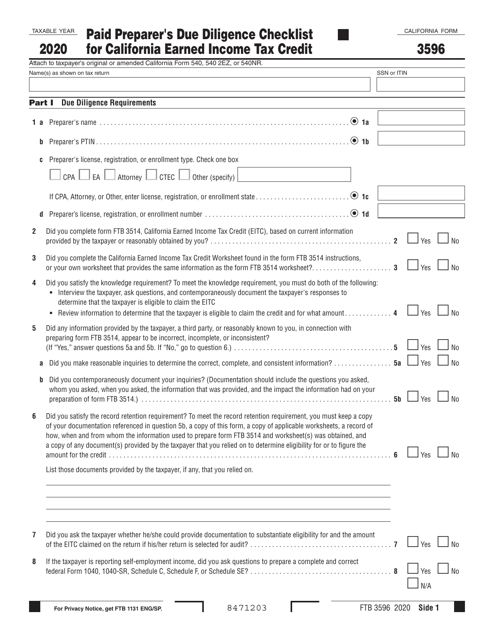

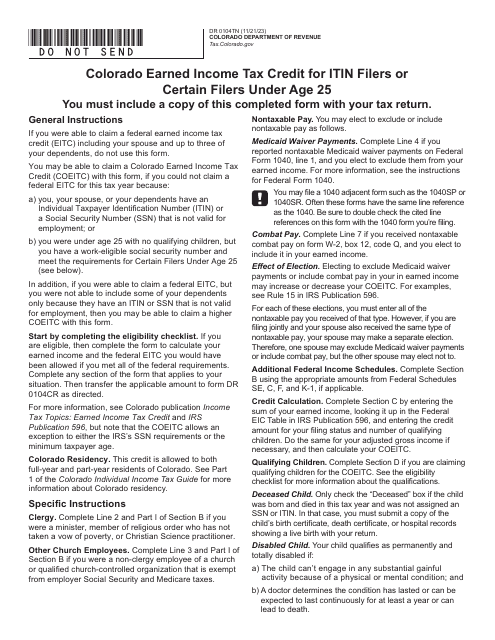

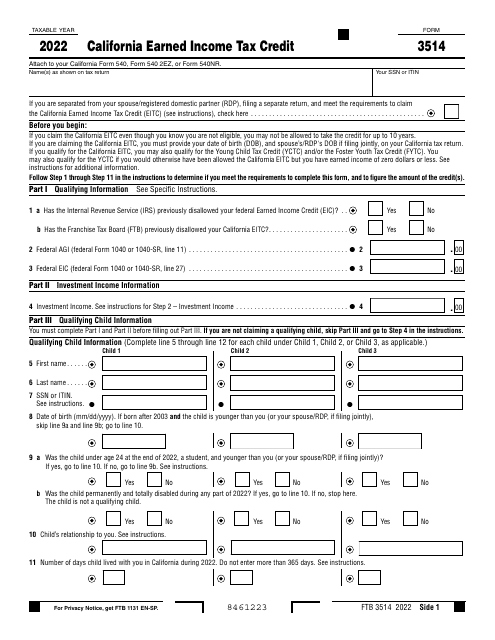

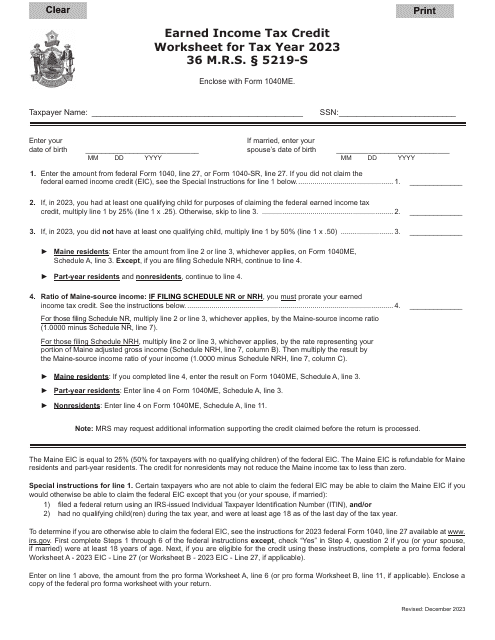

To take advantage of this tax credit, you will need to file the necessary forms and meet specific requirements. Some common documents related to the Earned Income Tax Credit include Form N-356 Earned Income Tax Credit - Hawaii, Form FTB3596 Paid Preparer's Due Diligence Checklist for California Earned Income Tax Credit - California, and Form DR0104TN Colorado Earned Income Tax Credit Checklist for Itin Filers or Certain Filers Under Age 25 - Colorado.

By utilizing the Earned Income Tax Credit, you may be able to increase your tax refund or reduce the amount of taxes you owe. It is crucial to ensure that you meet the eligibility criteria and complete the appropriate forms accurately to maximize your benefits.

If you believe you may qualify for the Earned Income Tax Credit, it is recommended to seek professional advice or consult with a tax preparer to ensure you are taking full advantage of this valuable tax benefit. Remember, the Earned Income Tax Credit provides a financial boost to hardworking individuals and families, so be sure to explore the possibilities and claim what you deserve.

Documents:

15

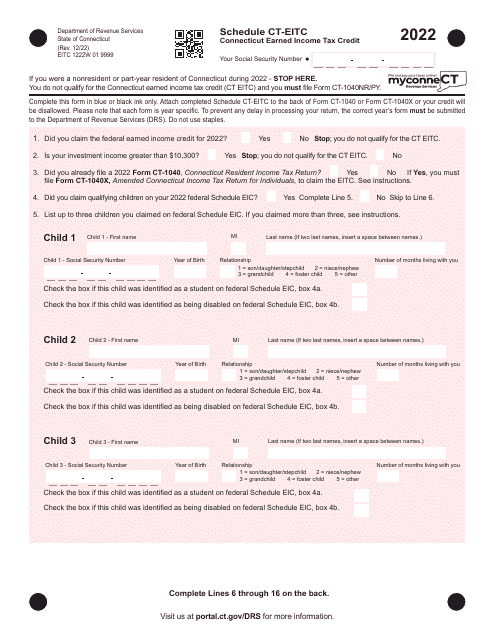

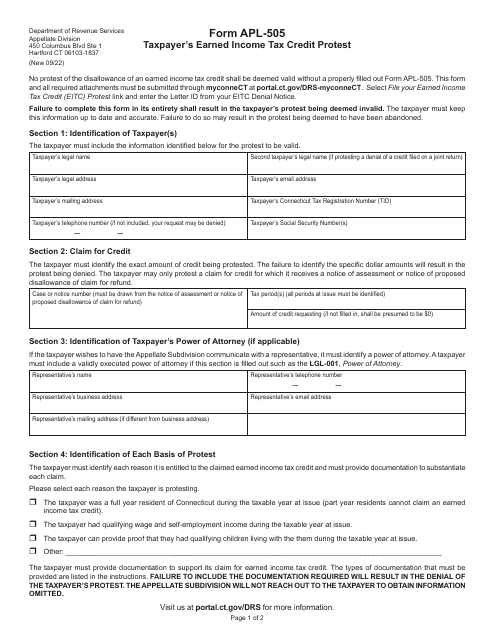

This form is used for taxpayers in Connecticut to protest their eligibility for the Earned Income Tax Credit.

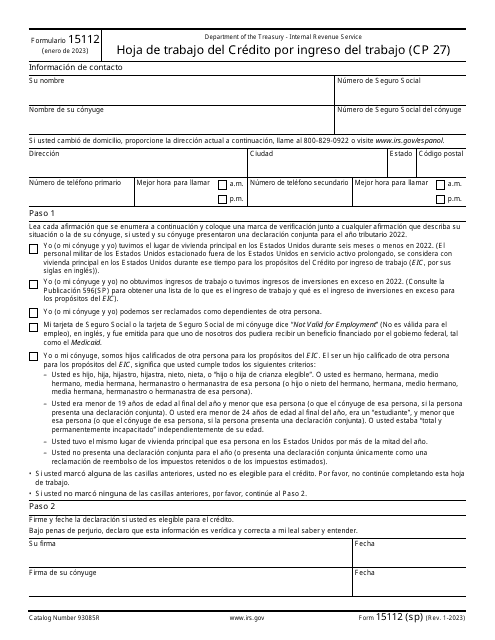

This document is a Spanish version of IRS Form 15112 (SP) and is used for the Worksheet for the Earned Income Credit (CP 27). It is used to calculate and claim the Earned Income Credit, a tax credit for low to moderate-income individuals and families.