Total Assets Templates

Are you a small business owner or a corporation with significant assets? If so, it's important to understand and properly manage your total assets. Total assets refer to the sum of all your company's tangible and intangible assets, including cash, property, equipment, and investments.

Managing your total assets effectively is crucial for financial planning, tax purposes, and overall business growth. By accurately calculating and reporting your total assets, you can make informed decisions and ensure compliance with regulatory requirements.

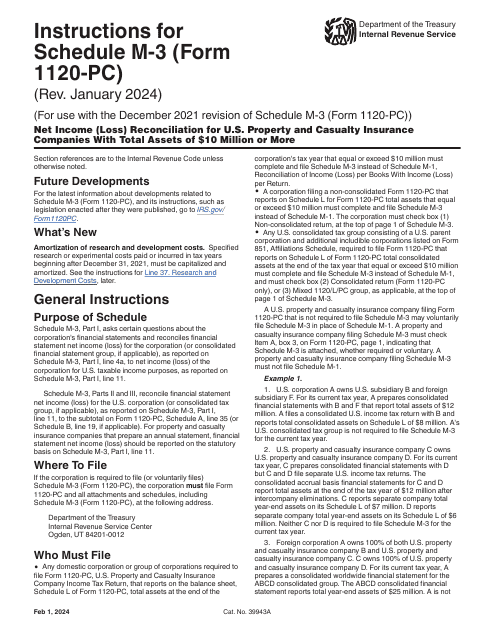

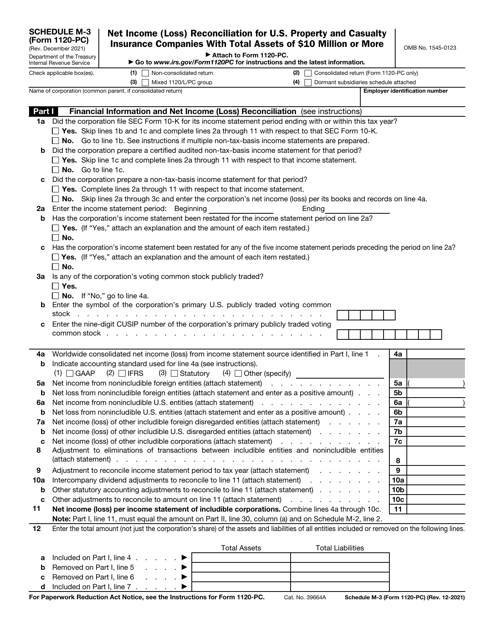

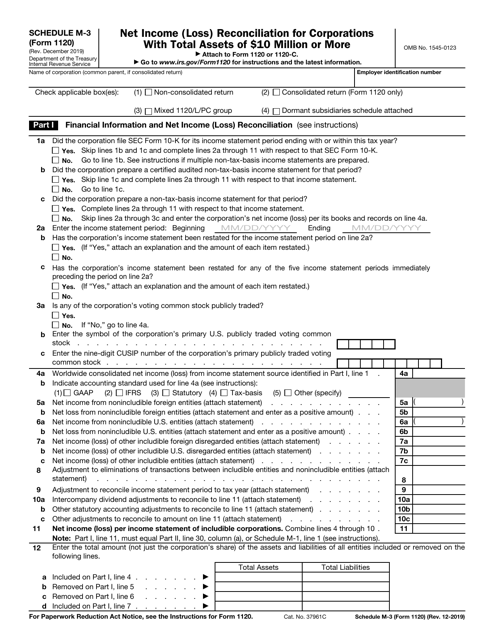

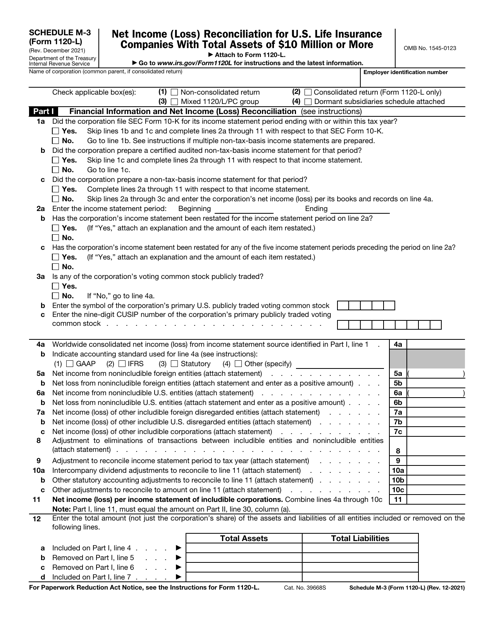

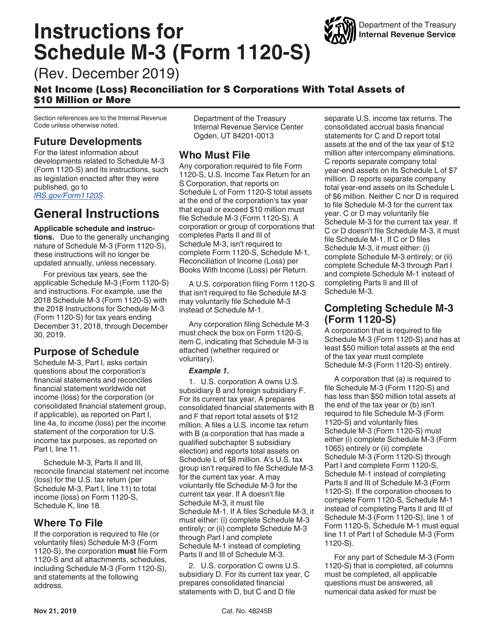

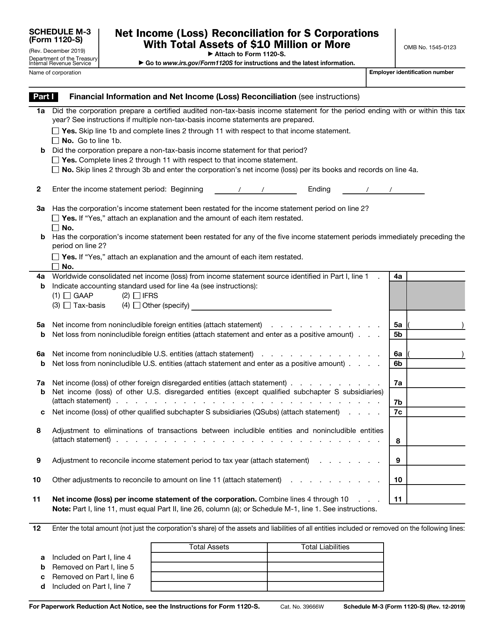

At times, you may be required to reconcile your net income or loss with your total assets. For example, if you are a U.S. property and casualtyinsurance company with total assets exceeding $10 million, you may need to complete IRS Form 1120-PC Schedule M-3. This form helps you reconcile your net income or loss with your total assets, ensuring accurate financial reporting.

To simplify the process, the IRS provides detailed instructions for completing these forms. These instructions will guide you through the necessary steps and highlight any specific requirements for your company's size and industry. The instructions cover topics such as income reconciliation, asset valuation, and reporting thresholds.

Whether you're a corporation or an insurance company, properly managing your total assets is vital for financial stability and compliance. Understanding the intricacies of forms like IRS Form 1120-PC Schedule M-3 will empower you to accurately report your net income or loss and maintain transparency in your financial statements.

Take control of your total assets and navigate complex financial reporting with ease. Ensure accurate calculations and compliance by utilizing the resources available to you. With the right knowledge and understanding, you can confidently manage your total assets and pave the way for success.

Documents:

28

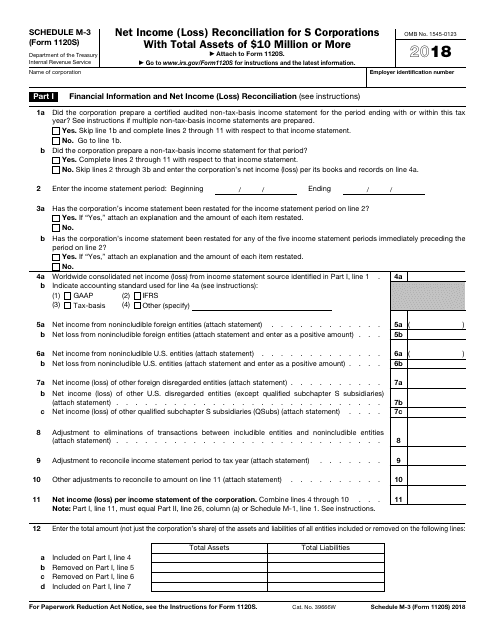

This Form is used for reconciling the net income (loss) of S corporations with total assets of $10 million or more on Schedule M-3.

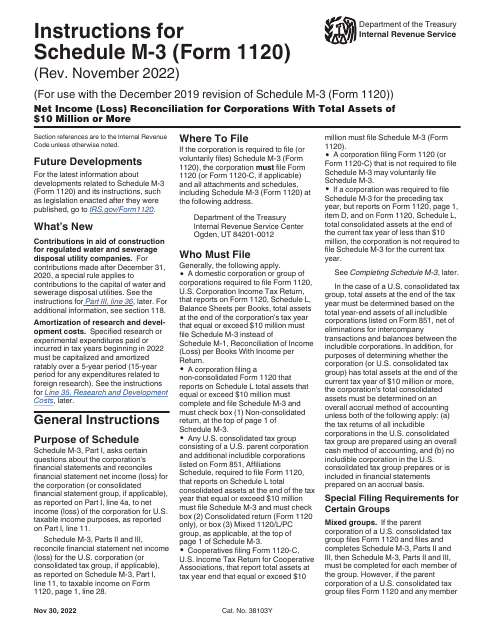

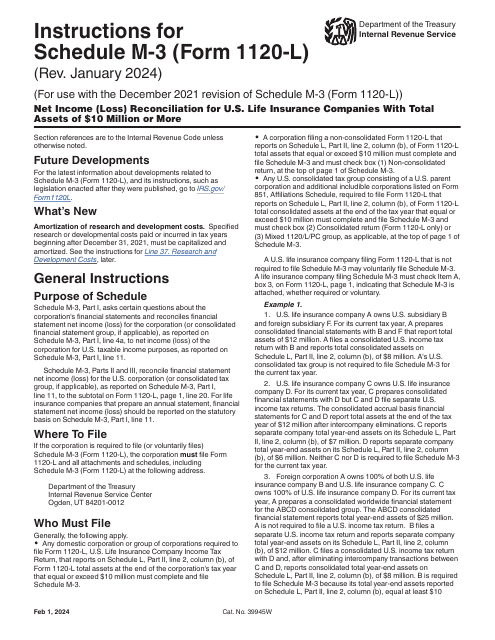

This form is used for reconciling the net income (or loss) of S Corporations with total assets of $10 million or more on Form 1120S. It provides detailed instructions for completing the Schedule M-3 section.

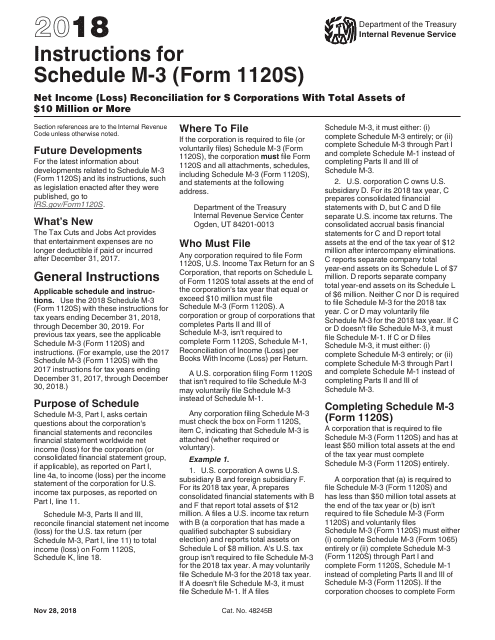

This Form is used for S corporations with total assets of $10 million or more to reconcile net income (loss) for tax purposes. It provides instructions for completing IRS Form 1120-S Schedule M-3.

This Form is used for net income (loss) reconciliation for S corporations with total assets of $10 million or more.

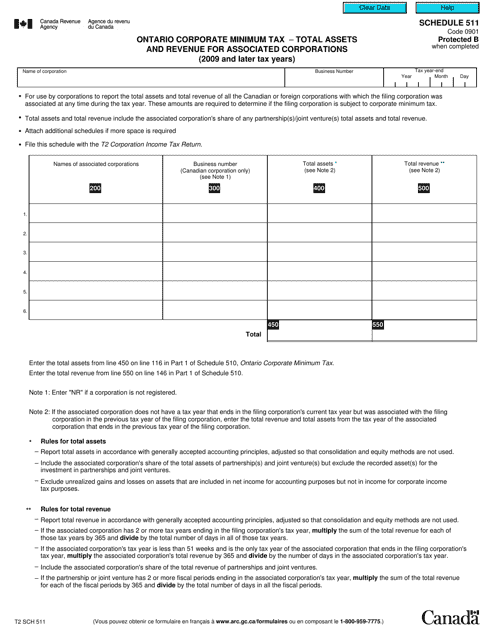

This form is used in Canada for reporting the total assets and revenue of associated corporations when calculating the Ontario Corporate Minimum Tax for tax years 2009 and later.

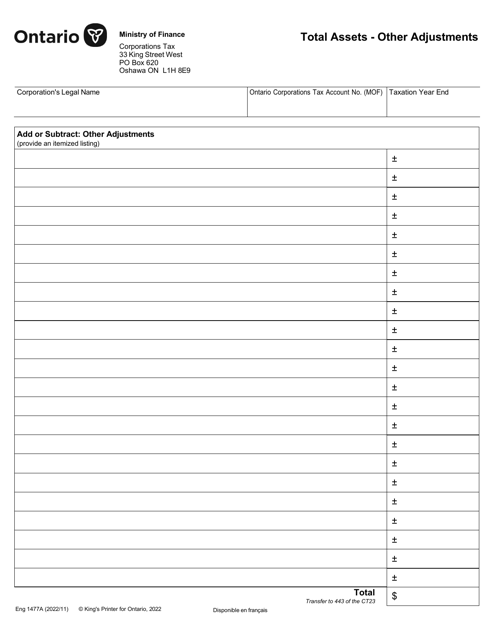

This form is used for reporting total assets and other adjustments specific to the province of Ontario in Canada.