Tax Credit Carry Forward Templates

Are you looking to maximize your tax savings? Are you interested in utilizing tax credits to offset your tax liability? Look no further than the tax credit carry forward program. With various names, including carried forward tax credits and tax credits carried forward, this program allows you to carry forward unused tax credits from previous years to future tax periods.

The tax credit carry forward program offers a strategic approach to managing your tax obligations. By taking advantage of this program, you can apply credits earned in past years to reduce your current or future tax liabilities. This means that even if you were unable to utilize your tax credits in previous years, you can still benefit from them in the future.

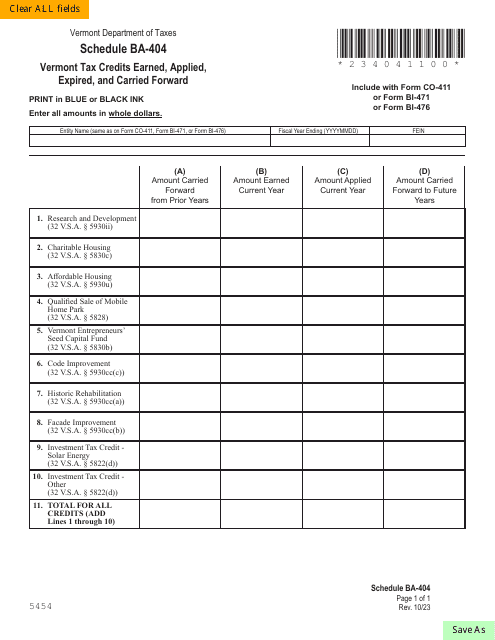

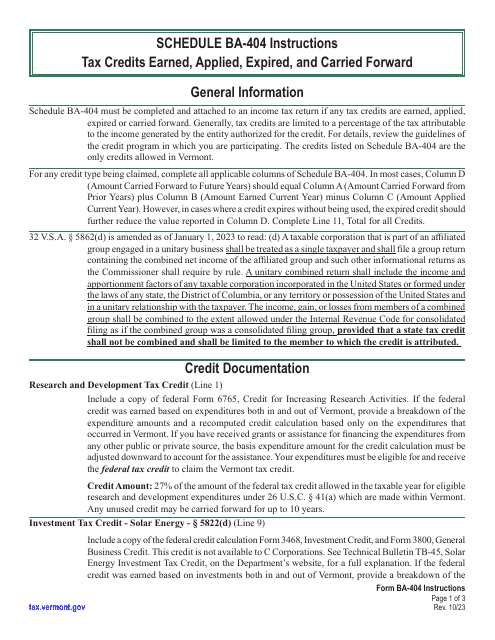

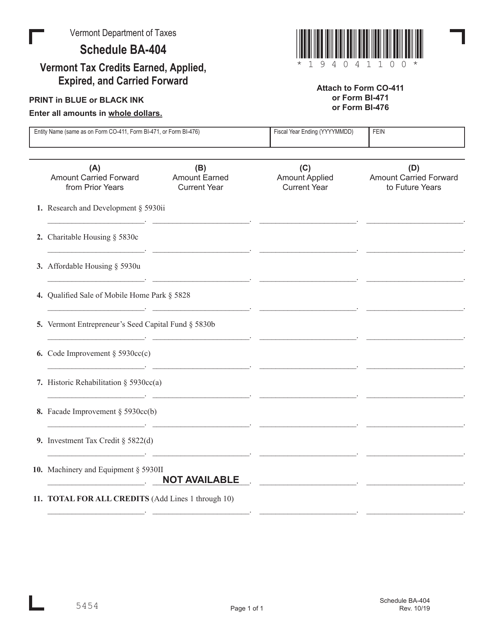

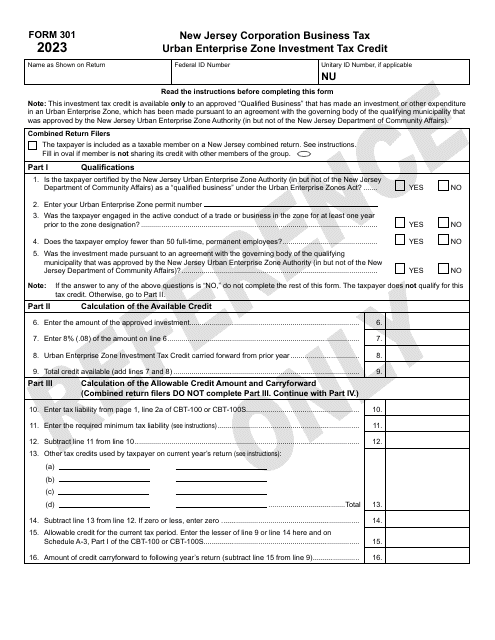

Our comprehensive collection of documents related to tax credit carry forward provides all the necessary information and guidelines you need to navigate this program. Whether you're a Vermont resident and need to consult the Schedule BA-404 Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont, or a New Jersey business owner in need of the Form 301 Urban Enterprise ZoneInvestment Tax Credit and Credit Carry Forward - New Jersey, we've got you covered.

Our documents cover a range of topics, from the instructions for Schedule BA-404 Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont to the Schedule BA-404 Vermont Tax Credits Earned, Applied, Expired, and Carried Forward - Vermont. These resources offer valuable insights into how to effectively utilize your tax credits to reduce your tax liability.

Take control of your tax planning and explore the tax credit carry forward program today. Don't let valuable credits go to waste - put them to good use and enjoy significant tax savings. With our comprehensive collection of documents, you'll have all the information you need to make informed decisions and optimize your tax benefits. Start maximizing your tax savings now!

Documents:

7

This Form is used for reporting Vermont tax credits earned, applied, expired, and carried forward.