Net Income Tax Templates

Net Income Tax is a crucial aspect of the tax system in various countries, including the USA and Canada. It is a tax imposed on the net income or profits earned by individuals, corporations, and other entities. This tax is levied on both personal and business income, ensuring that individuals and companies contribute their fair share towards the overall tax revenue.

The collection of documents pertaining to Net Income Tax provides individuals and businesses with the necessary forms and guidelines to accurately calculate and report their net income tax. These documents offer comprehensive instructions on how tofill out tax-related forms, ensuring compliance with the relevant tax laws and regulations.

The alternate names for this collection, such as "Net Income Tax Forms" or "Documents for Calculating Net Income Tax," highlight the purpose of these documents - simplifying the process of reporting and paying Net Income Tax. By using these documents, individuals and businesses can fulfill their tax obligations correctly and efficiently, avoiding potential penalties or legal issues.

Whether you are an individual taxpayer or a corporation, having access to the right Net Income Tax documents is essential. These documents enable you to accurately report your income and deductions, providing transparency and contributing to the overall tax system's integrity.

Please note that all the documents in this collection are specific to respective states or provinces, as each jurisdiction may have its own regulations and requirements regarding Net Income Tax. Therefore, it is necessary to ensure you select the appropriate documents based on your location to comply with the relevant laws.

Documents:

13

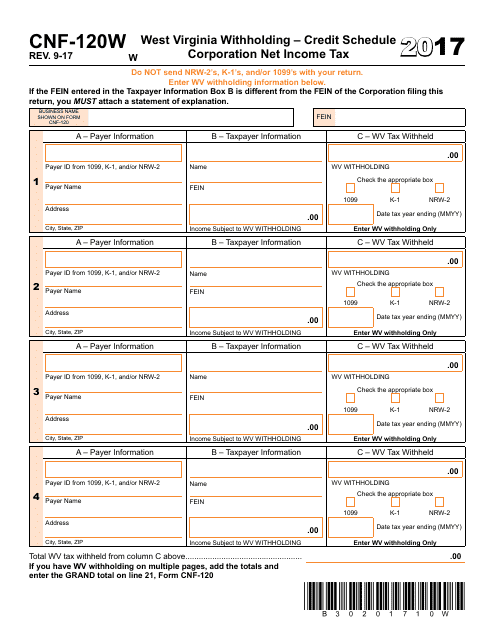

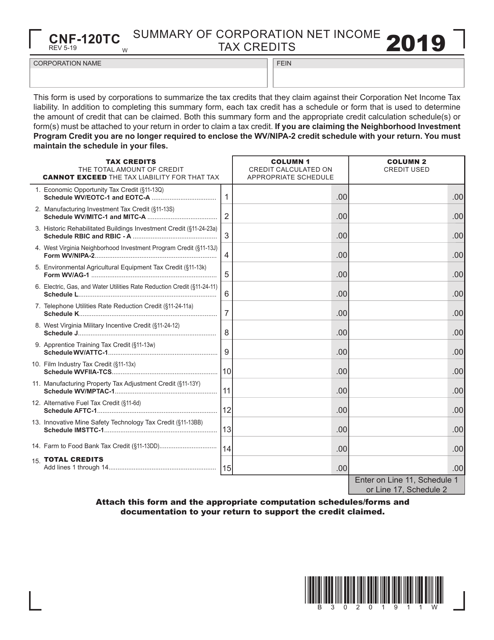

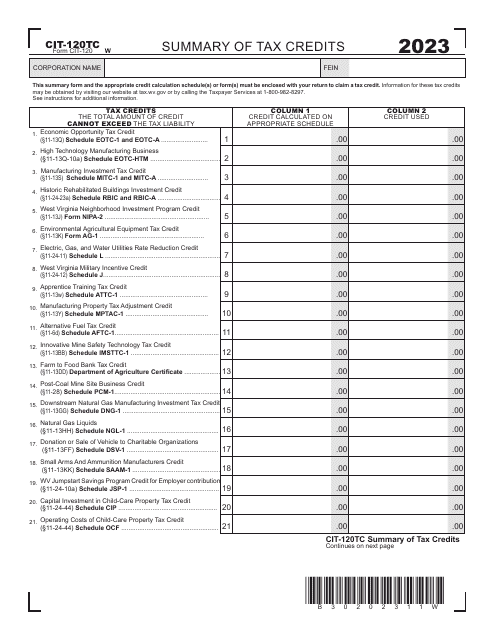

This form is used for reporting and calculating the credit schedule for corporation net income tax in West Virginia. The form is specifically for corporations that are withholding taxes in West Virginia.

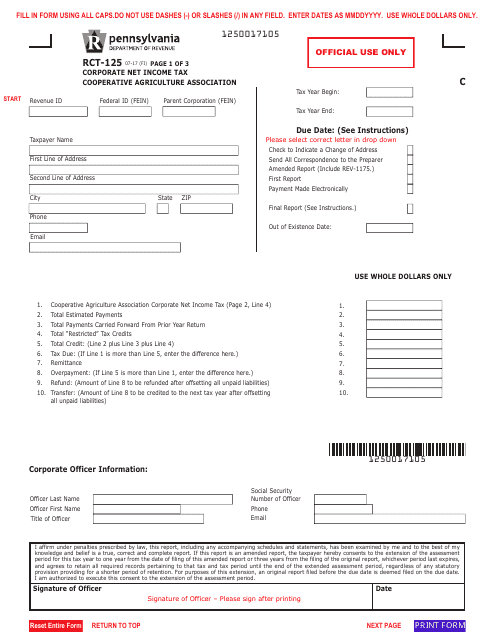

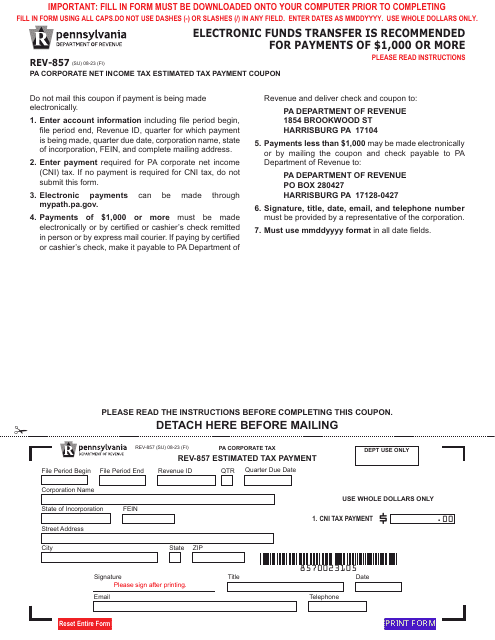

This form is used for reporting the corporate net income tax of Cooperative Agriculture Associations in Pennsylvania.

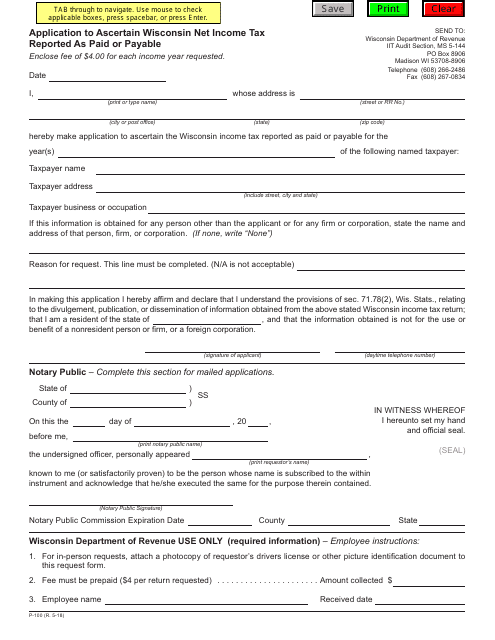

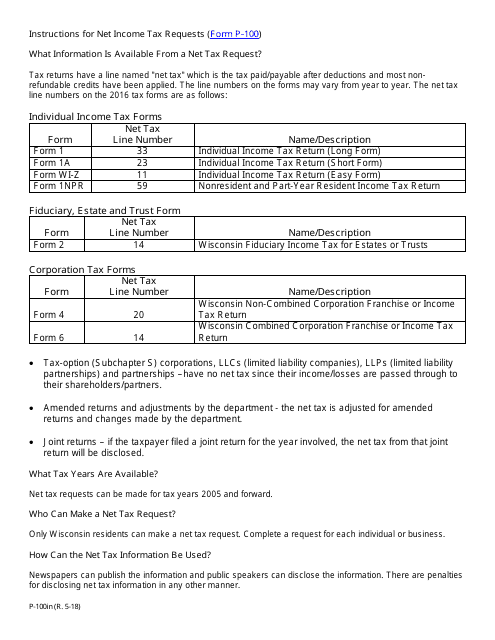

Form P-100 Application to Ascertain Wisconsin Net Income Tax Reported as Paid or Payable - Wisconsin

This Form is used for calculating the net income tax reported as paid or payable in the state of Wisconsin.

This Form is used for applying to determine the amount of Wisconsin net income tax reported as paid or payable.

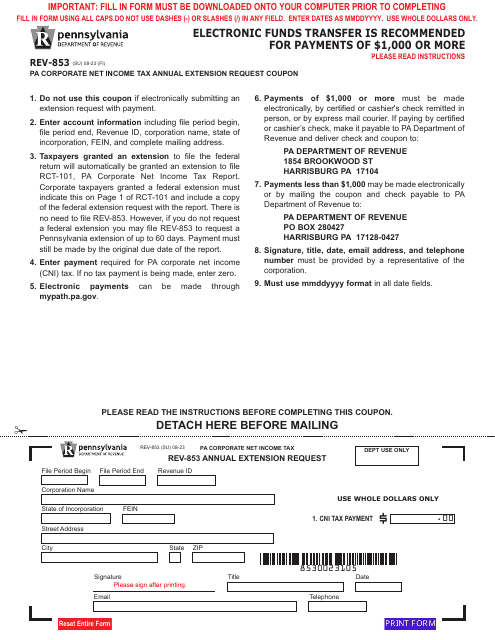

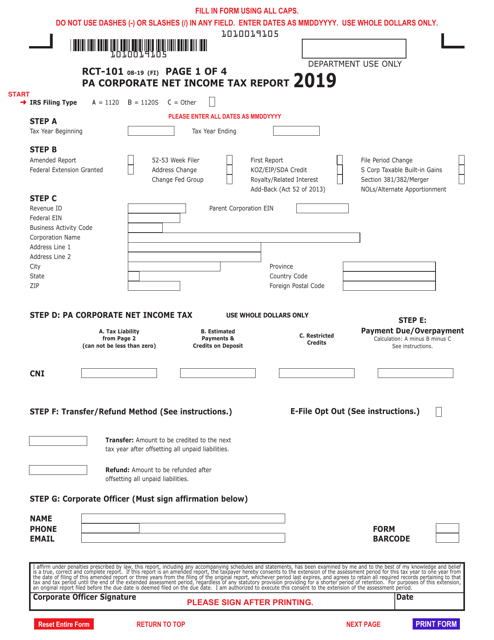

This form is used for reporting corporate net income tax in the state of Pennsylvania.

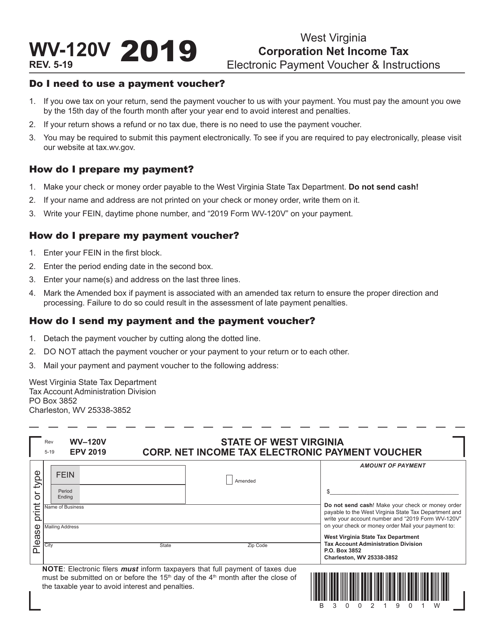

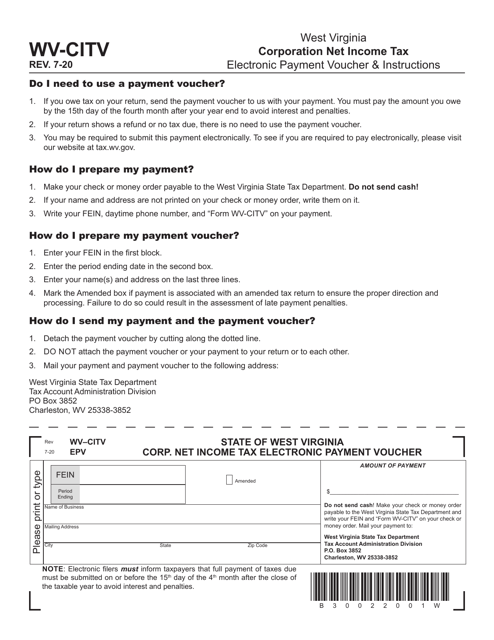

This form is used for electronic payment of corporation net income tax in West Virginia.